The Moderating Effect of Corporate Transparency on the Relationship between Audit Quality, Audit Committee, Ownership Structure, and Reporting Quality

DOI:

https://doi.org/10.51967/tanesa.v26i1.3366Keywords:

Third Party Funds, Capital Adequacy, Credit Distribution, Operational Efficiency, ProfitabilityAbstract

This study aims to analyze the moderating effect of corporate transparency on the relationship between audit quality, audit committee, and ownership structure on the quality of financial reporting in banking companies listed on the Indonesia Stock Exchange during the 2019–2023 period. The research employs a quantitative method with data analysis conducted using SPSS version 25. The results indicate that audit quality and the audit committee have a significant effect on the quality of financial reporting. On the other hand, ownership structure does not have a significant effect on financial reporting quality. Corporate transparency is proven to moderate the influence of audit quality and the audit committee on financial reporting quality; however, transparency does not moderate the influence of ownership structure on financial reporting quality.

References

• REFERENSI

Alfina, N., & Hidayah, N. (2023). The effectiveness of audit committees in improving financial reporting quality: Evidence from Indonesian listed companies. Jurnal Akuntansi Multiparadigma.

Andriyani, N. W. F., Efendi, F., Chen, C.-M., Nursalam, N., Kurniati, A., & Nancarrow, S. A. (2016). How to attract health students to remote areas in Indonesia: a discrete choice experiment. International Journal of Health Planning and Management.

Ardiansyah, R., & Lestari, S. (2024). Ownership structure and financial reporting quality: Evidence from emerging markets. Jurnal Ilmu Dan Riset Akuntansi.

Ardiyos. (2017). Kamus Standar Akuntansi. Citra Harta Prima Andayani.

Atika Sandra Dewi dan Tarmizi. (2023). The Application of Force Majeure in the Resolution of Unpaid Debts at Banking Institutions Resulting from Natural Disasters. Russian Law Journal.

Otoritas Jasa Keuangan. (2023). Laporan Tahunan OJK

DeAngelo. (1981). Auditor Size and Audit Quality. Journal of Accounting and Economics.

Dechow, P. M., Ge, W., Larson, C. R., & Sloan, R. G. (2011). Predicting Material Accounting Misstatements. Contemporary Accounting Research.

Dewi, K. A., & Putra, I. M. A. (2023). Analisis pengaruh struktur kepemilikan terhadap kualitas pelaporan keuangan pada perusahaan sektor manufaktur di Indonesia. Jurnal Akuntansi Aktual. Jurnal Akuntansi Aktual.

Firmansyah, R., & Dewi, A. Y. (2024). The moderating effect of transparency on the relationship between audit committee effectiveness and financial reporting quality. Jurnal Akuntansi Dan Bisnis.

Fitriani, Y., & Nugraha, A. D. (2024). Do ownership types matter for financial reporting quality? An Indonesian evidence. Journal of Contemporary Accounting Research.

Francis, J. R., Reichelt, K. J., & Wang, D. (2005). The pricing of national and city-specific reputations for industry expertise in the U.S. audit market. The Accounting Review.

Frederic, S. M. (2021). Ekonomi uang, perbankan, dan pasar keuangan Edisi II. Salemba Empat.

Ghozali. (2016). Aplikasi Analisis Multivariate dengan Program IBM SPSS 23. Badan Penerbit Universitas Diponegoro.

Hanafiah, S., & Sari, D. A. (2024). Audit committee activity and financial reporting quality: An Indonesian perspective. Jurnal Akuntansi Dan Keuangan.

Handayani dan Siregar. (2024). The role of transparency in enhancing the effectiveness of audit quality toward financial reporting quality. Jurnal Akuntansi Dan Keuangan Indonesia.

Healy, P. M., & Wahlen, J. M. (2020). A Review of the Earnings Management Literature and Its Implications for Standard Setting. Accounting Horizons.

Herlin Novrilia, F. Indra Arza, dan V. F. S. (2019). Pengaruh Fee Audit, Audit Tenure, dan Reputasi KAP terhadap Kualitas Audit. Jurnal Eksplorasi Akuntansi.

Hidayat dan Lestari. (2024). Transparency, audit committee, and financial reporting: Empirical evidence from Indonesia. Jurnal Tata Kelola & Akuntabilitas Keuangan Negara.

Hope. (2022). Large shareholders and accounting research. China Journal of Accounting Research.

Juan Manuel García Lara, Beatriz García Osma, dan A. K. (2023). Accounting Conservatism and the Agency Problems of Overvalued Equity. Review of Accounting Studies (Forthcoming).

Mardiasmo. (2010). Akuntansi Sektor Publik. Andi Offset.

Mulaydi. (2015). Akuntansi Biaya. UPP STIM YKPN.

Pangaribuan, D. B., Silaban, A., & Sijabat, J. (2023). The influence of the audit committee characteristics on the quality of earnings in banking companies listed on the Indonesia Stock Exchange in 2019–2021. Pendidikan Tambusai.

Pratama dan Nurhayati. (2023). Audit quality, transparency, and financial reporting quality: An interaction effect. Journal of Accounting Research and Audit.

Putri dan Ramadhani. (2024). Transparency as a moderating variable between audit quality and financial reporting quality. Jurnal Akuntansi Kontemporer.

Rahmawati dan Jannah. (2024). Ownership structure, transparency, and financial reporting quality: Testing the moderating role of disclosure. Jurnal Akuntansi Multiparadigma.

Rohmah, R. N., & Yusniar, R. (2024). Competence of audit committee members and its impact on financial reporting quality. Journal of Accounting and Auditing Review.

Sekaran & Bougie. (2021). Research Methods for Business: A Skill-Building Approach. Hoboken, New Jersey.

Sugiyono. (2022). Metode Penelitian Kuantitatif, Kualitatif, dan R&D. CV. Alfabeta.

Suryani dan Maulana. (2023). Does transparency moderate the relationship between ownership structure and financial reporting quality? Evidence from Indonesia. Jurnal Ekonomi Dan Keuangan.

Downloads

Published

How to Cite

Issue

Section

License

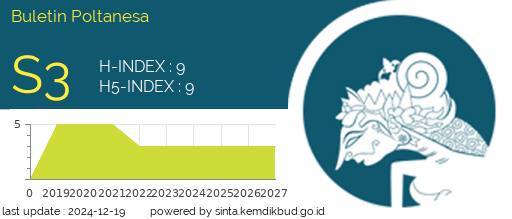

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.