Analysis of Compliance of Rural and Urban Land and Building Taxpayers in Pontianak

DOI:

https://doi.org/10.51967/tanesa.v26i1.3365Keywords:

Compliance, Taxpayer, Rural and Urban Land and Building TaxAbstract

This study aims to examine the compliance level of Rural and Urban Land and Building Tax (PBB-P2) in Pontianak City, explore the challenges faced by the Regional Finance Agency (BKD) in its collection process, and assess the strategies implemented to enhance tax revenue. Employing a qualitative descriptive case study approach, the research collects data through interviews, analysis of PBB-P2 revenue realization documents, and literature review. The findings reveal that taxpayer compliance remains relatively low, primarily due to limited awareness, insufficient information dissemination, and administrative issues such as undelivered physical SPPT (Tax Due Notification Letters). To address these challenges, BKD Pontianak has adopted several strategies, including simplifying payment procedures, intensifying public outreach, and conducting direct appeals to residents. This underscores the practical need for improved education and accessible tax information to foster higher compliance rates. The findings also offer valuable insights for local governments in formulating more effective public engagement strategies, such as leveraging digital platforms and offering mobile tax services. Uniquely, this study contributes original value by presenting five years of consistent PBB-P2 compliance data—an area that has received limited academic attention—while also providing deeper qualitative insights into local-level tax collection issues and solutions.

References

Amalia, A. R., & Anwar, S. (2023). Pengaruh Modernisasi Sistem Administrasi Perpajakan Terhadap Kepatuhan Wajib Pajak Kendaraan Bermotor Dimoderasi Sosialisasi Perpajakan. Equilibrium: Jurnal Ilmiah Ekonomi, Manajemen Dan Akuntansi, 12(2), 247–256. http://dx.doi.org/10.35906/equili.v12i2.1580

Bani-Khalid, T., Alshira’h, A. F., & Alshirah, M. H. (2022). Determinants Of Tax Compliance Intention Among Jordanian Smes: A Focus On The Theory Of Planned Behavior. Economies, 10(2), 30. https://doi.org/10.3390/economies10020030

Djatmiko, G. H., Sinaga, O., & Pawirosumarto, S. (2025). Digital Transformation And Social Inclusion In Public Services: A Qualitative Analysis Of E-Government Adoption For Marginalized Communities In Sustainable Governance. Sustainability, 17(7), 2908. https://doi.org/10.3390/su17072908

Gahung, P. C., Warongan, J. D., & Mintalangi, S. S. (2024). Pengaruh Pengetahuan Perpajakan, Kesadaran Wajib Pajak, Dan Kepercayaan Masyarakat Pada Pemerintah Terhadap Kepatuhan Wajib Pajak Dalam Membayar Pajak Bumi Dan Bangunan Perdesaan Dan Perkotaan (PBB-P2) Di Kecamatan Pasan Kabupaten Minahasa Tenggara. Riset Akuntansi Dan Portofolio Investasi, 2(2), 143–149. https://doi.org/10.58 784/rapi.145

Hantono, H., & Sianturi, R. F. (2022). Pengaruh Pengetahuan Pajak, Sanksi Pajak Terhadap Kepatuhan Pajak Pada UMKM Kota Medan. Owner: Riset Dan Jurnal Akuntansi, 6(1), 747–758. https://doi.org/10.33395/owner.v6i1.628

Herlina, H., & Putra, R. J. (2024). Faktor–Faktor Yang Mempengaruhi Persepsi Terhadap Kepatuhan Wajib Pajak. Owner: Riset Dan Jurnal Akuntansi, 8(2), 1930–1942. https://doi.org/10.33395/owner.v8i2.2006

Hidayat, I., & Maulana, L. (2022). Pengaruh Kesadaran Wajib Pajak, Sanksi Pajak, Dan Kualitas Pelayanan Pajak Terhadap Kepatuhan Wajib Pajak Kendaraan Bermotor Di Kota Tangerang: Pengaruh Kesadaran Wajib Pajak, Sanksi Pajak, Dan Kualitas Pelayanan Pajak Terhadap Kepatuhan Wajib Pajak Kendaraan Bermotor Di Kota Tangerang. Bongaya Journal Of Research In Accounting (BJRA), 5(1), 11–35. https://doi.org/10.37888/bjra.v5i1.322

Kadafi, M., Rahman, F., & Safitri, T. (2022). The Impact Of E-Billing, Tax Literacy, Tax Socialization, And Financial Information Quality On Self-Assessment Effectiveness. International Conference On Applied Science And Technology On Social Science 2022 (Icast-SS 2022), https://doi.org/10.2991/978-2-494069-83-1_113

Lovianna, L., & Rahmi, N. (2022). Analisis Efektivitas Dan Kontribusi Pajak Daerah Sebagai Sumber Pendapatan Asli Daerah (Studi Pada Bapenda DKI Jakarta Tahun 2016-2020). Jurnal Pajak Vokasi (JUPASI), 3(2), 109–117. https://doi.org/10.31334/jupasi .v3i2.2212

Mislaturrina, M., Razif, R., Khaddafi, M., & Rais, R. G. P. (2023). Analisis Kepuasan Wajib Pajak Dan Kepatuhan Wajib Pajak Terhadap Fasilitas Program Si Jempol (Jemput Pajak Online) Di Samsat Kota Lhokseumawe. Jurnal Akuntansi Malikussaleh (JAM), 1(2), 274–291. https://doi.org/10.29103/jam.v1i2.8651

Muammalah, A., & Ninditha, S. R. (2021). Analisis Tingkat Kepatuhan Wajib Pajak Terhadap Penerimaan Pajak Bumi Dan Bangunan Dimasa Pandemi Covid-19 Pada Bapenda Bandung. Media Ekonomi, 29(2), 85–98. https://doi.org/10.25105/me.v29i2.10721

Puspita, I. H., & Setyawan, S. (2022). Analisis Kepatuhan Wajib Pajak Berdasarkan Realisasi Penerimaan PBB Pada BPPKAD Kabupaten Purworejo. Transekonomika: Akuntansi, Bisnis Dan Keuangan, 2(3), 83–94. https://doi.org/10.55047/transekonomika.v 2i3.131

Setjoatmadja, D. S. (2021). Penyelesaian Sengketa Dan Tindak Pidana Perpajakan (Pendekatan Keadilan Restoratif). . Jejak Pustaka.

Sompa, E. B. T., & Yulianto, Y. (2025). Pengaruh Pemahaman Peraturan Perpajakan, Sosialisasi Perpajakan Dan Edukasi Perpajakan Terhadap Tingkat Kepatuhan Wajib Pajak Pegawai Direktorat Navigasi Penerbangan. Jurnal Pajak Vokasi (JUPASI), 6(2), 63–67. https://doi.org/10.31334/jupasi.v6i2.4358

Supramono, & Damayanti, T. W. (2010). Perpajakan Indonesia- Mekanisme Dan Perhitungan. Andi Offset.

Turnip, M. W., & Thamrin, M. H. (2024). Pengaruh Layanan E-Samsat Terhadap Kepatuhan Wajib Pajak Kendaraan Bermotor Di UPTD Pependa Medan Selatan. PERSPEKTIF, 13(4), 1049–1058. https://doi.org/10.31289/perspektif.v13i4.12913

Zahra, F., & Rulandari, N. (2020). Metode Penelitian Kuantitatif, Kualitatig, Dan R&D. Jurnal Pajak Vokasi (JUPASI), 2(1), 1–10. https://doi.org/10.31334/jupasi.v2i1.1109

Zikrulloh, Z. (2023). The Role Of Social Media In Improving Tax Compliance In The Theory Of Planned Behavior. Jurnal Komunikasi Ikatan Sarjana Komunikasi Indonesia, 8(2), 415–425. https://doi.org/10.25008/jkiski.v8i2.910

Downloads

Published

How to Cite

Issue

Section

License

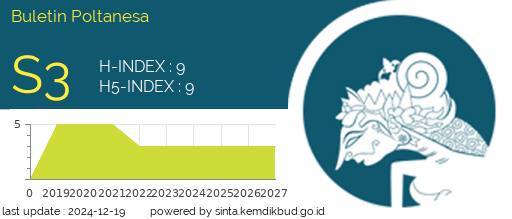

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.