Blockchain Technology as an Innovation in Tax Administration: A Study of its Impact on Tax Compliance

DOI:

https://doi.org/10.51967/tanesa.v26i1.3360Keywords:

Blockchain Technology, Digital Tax Administration, Tax Compliance, PLS-SEM.Abstract

This study aims to analyze the influence of blockchain technology on tax compliance, with ease of digital tax administration as a mediating variable. The background of this research lies in the importance of technological innovation in building a transparent, efficient, and accountable tax administration system. The research method used is a quantitative approach with analysis techniques based on Partial Least Squares Structural Equation Modeling (PLS-SEM), utilizing data from taxpayers who possess a Taxpayer Identification Number (NPWP) and are employed at the Audit Board of Indonesia (BPK) in West Kalimantan. The results show that blockchain technology has a positive and significant influence on tax compliance, as well as a positive effect on the ease of digital tax administration. Furthermore, ease of digital tax administration is also proven to have a positive and significant effect on tax compliance. Another key finding indicates that ease of digital administration mediates the relationship between blockchain technology and tax compliance. Therefore, integrating blockchain technology into the tax system will be more effective if supported by an administrative system that is user-friendly, efficient, and digitally integrated. This study offers important implications for tax authorities in designing technology-based policies that can sustainably improve tax compliance.

References

Direktorat Jenderal Pajak. (2023). Laporan Kinerja Direktorat Jenderal Pajak Tahun 2023. Direktorat Jenderal Pajak, Kementerian Keuangan Republik Indonesia. https://www.pajak.go.id

DLA Piper. (2024, August). Argentine legal news on blockchain and crypto assets. DLA Piper. https://www.dlapiper.com/en/insights/publications/2024/08/argentine-legal-news-on-blockchain-and-crypto-assets2

Fjeldstad, O. H., & Heggstad, K. (2012). Building taxpayer culture in Mozambique, Tanzania and Zambia: Achievements, challenges and policy recommendations (CMI Report No. R 2012:1). Chr. Michelsen Institute.

Fjeldstad, O.-H., & Heggstad, K. (2012). Building taxpayer trust: Evidence from Sub-Saharan Africa. ICTD Working Paper.

Hesami, S., Jenkins, H., & Jenkins, G. P. (2024). Digital transformation of tax administration and compliance: A systematic literature review on e-invoicing and prefilled returns. Digital Government: Research and Practice, 5(3), Article 18. https://www.researchgate.net/publication/377818326

Kim, H. M., & Lee, H. S. (2021). Blockchain technology and its impact on the accounting and auditing profession. Journal of Theoretical Accounting Research, 16(1), 45–62.

Kim, J., & Lee, H. (2021). Blockchain-based tax administration system: Empirical analysis of taxpayer trust and compliance intention. Government Information Quarterly, 38(4), 101599. https://doi.org/10.1016/j.giq.2021.101599

Kim, Y., & Lee, J. (2021). Blockchain adoption and tax compliance: An empirical investigation. International Journal of Accounting Information Systems, 40.

Kirchler, E., Hoelzl, E., & Wahl, I. (2008). Enforced versus voluntary tax compliance: The “slippery slope” framework. Journal of Economic Psychology, 29(2), 210–225.

Mazur, O. W. (2022). Can blockchain revolutionize tax administration? Penn State Law Review, 127(1), 115–160.

OECD. (2020). Tax administration 2020: Comparative information on OECD and other advanced and emerging economies. OECD Publishing.

OECD. (2020). Tax Administration 3.0: The digital transformation of tax administration. https://www.oecd.org/tax/forum-on-tax-administration/publications-and-products/tax-administration-3-0-the-digital-transformation-of-tax-administration.htm

OECD. (2022). Tax Administration 3.0 and the digital identification of taxpayers. https://www.oecd.org/tax/forum-on-tax-administration/publications-and-products/tax-administration-3-0-and-the-digital-identification-of-taxpayers.htm

Schmidt, C. G., & Sandner, P. (2017). Blockchain technology in the German tax system: A critical analysis and evaluation. Frankfurt School of Finance & Management Working Paper, No. 238. https://doi.org/10.2139/ssrn.3079367

Schmidt, C. G., & Sandner, P. (2017). Solving challenges of the European VAT system with blockchain technology. Frankfurt School Blockchain Center.

Schmidt, J., & Sandner, P. (2017). Blockchain technology in the tax system: Use cases and implications. Journal of Business and Financial Affairs, 6(2).

Swan, M. (2015). Blockchain: Blueprint for a new economy. O'Reilly Media.

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 27(3), 425–478. https://doi.org/10.2307/30036540

World Economic Forum. (2021). Blockchain deployment toolkit: Accelerating the adoption of blockchain technology in government and business.

Downloads

Published

How to Cite

Issue

Section

License

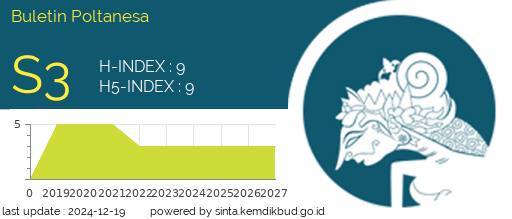

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.