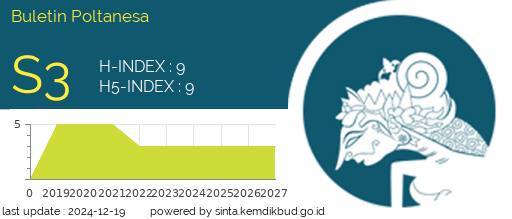

How Do Profitability and Tax Avoidance Influence Enterprise Value in the Food and Beverages Sub-Sector?

DOI:

https://doi.org/10.51967/tanesa.v26i1.3345Keywords:

Enterprise Value, Profitability, Return on Asset, Tax Avoidance, Effective Tax RateAbstract

Every company aspires to increase its value through business activities to achieve its goals. Enterprise or firm value is a crucial determinant of a company's overall well-being for investors. Profitability and tax avoidance are some of the many factors that determine this value. This research uses a quantitative method that studies manufacturing companies of the food and beverages sub-sector listed on the Indonesia Stock Exchange (IDX) from 2017 to 2020 as samples. The findings of this study show that profitability, indicated by return on assets (ROA), affects enterprise value, where t-value > t-table (14.156 > 1.674) with a significance of 0.000 > 0.05, so it is concluded that profitability has a positive significant influence on enterprise value. Similarly, Tax Avoidance, measured with effective tax rate (ETR), affects enterprise value, where t-value > t-table (3.901 > 1.674) with a significance of 0.000 > 0.05, so it is deduced that Tax Avoidance has a positive significant influence on enterprise value.

References

Ampriyanti, N. M., & Merkusiwati, N. K. L. 2016).Pengaruh tax avoidance jangka panjang terhadap nilai perusahaan dengan karakter eksekutif sebagai variabel pemoderasi. E-Jurnal Akuntansi, 16(3), 2231-2259.

Annisa, N. A., & Kurniasih, L. (2012). Pengaruh corporate governance terhadap tax avoidance. Jurnal akuntansi dan Auditing, 8(2), 123-136.

Aprilia, R. (2019). Pengaruh Leverage, Profitabilitas Dan Ukuran Perusahaan Terhadap Nilai Perusahaan Pada Perusahaan Otomotif Yang Terdaftar Di Bursa Efek Indonesia [Skripsi]. Universitas Muhammadiyah Sumatera Utara.

Ayu, D. P., & Suarjaya, A. A. G. (2017). Pengaruh Profitabilitas Terhadap Nilai Perusahaan Dengan Corporate Social Responsibility Sebagai Variabel Mediasi Pada Perusahaan Pertambangan. E-Jurnal Manajemen Unud, 6(2), 1112–1138.

Budiman, J., & Miharjo, S. (2012). Pengaruh Karakter Eksekutif Terhadap Penghindaran Pajak (Tax Avoidance) [Thesis]. Universitas Gadjah Mada.

Chasbiandani, T., & Martani, D. (2012). Pengaruh tax avoidance jangka panjang terhadap nilai perusahaan. Simposium Nasional Akuntansi XV, 90.

Chen, X., Hu, N., Wang, X., & Tang, X. (2014). Tax avoidance and firm value: evidence from China. Nankai Business Review International, 5(1), 25–42. https://doi.org/https://doi.org/10.1108/NBRI-10-2013-0037

Desai, M. A., & Dharmapala, D. (2007). Corporate Tax Avoidance and Firm Value. The Review of Economics and Statistics, 91(3), 537–546. https://doi.org/https://doi.org/10.2139/ssrn.689562

Dewi, H. K. (2019, May 8). Tax Justice laporkan Bentoel lakukan penghindaran pajak, Indonesia rugi US$ 14 juta. Kontan.Co.Id. https://nasional.kontan.co.id/news/tax-justice-laporkan-bentoel-lakukan-penghindaran-pajak-indonesia-rugi-rp-14-juta

Gresnews. (2013, September 12). Indofood Sukses Makmur Kalah di Peninjauan Kembali MA. Gresnews.Com.https://www.gresnews.com/artikel/81932/Indofood-Sukses-Makmur-Kalah-di-Peninjauan-Kembali-MA/

Hartono, J. (2017). Teori Portofolio dan Analisis Investasi (11th ed.). BPFE-Yogyakarta.

Herdiyanto, D. G., & Ardiyanto, Moh. D. (2015). Pengaruh Tax Avoidance Terhadap Nilai Perusahaan. Diponegoro Journal of Accounting, 4(3), 1–10. http://ejournal-s1.undip.ac.id/index.php/accounting

Ilmiani, A., & Sutrisno, C. R. (2014). Pengaruh Tax Avoidance Terhadap Nilai Perusahaan Dengan Transparansi Perusahaan Sebagai Variabel Moderating. Jurnal Ekonomi Dan Bisnis, 14(1). https://doi.org/https://doi.org/10.31941/jebi.v14i1.194

Jensen, M. C., Meckling, W. H., Benston, G., Canes, M., Henderson, D., Leffler, K., Long, J., Smith, C., Thompson, R., Watts, R., & Zimmerman, J. (1976). Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. In Journal of Financial Economics (Issue 4). Harvard University Press.http://hupress.harvard.edu/catalog/JENTHF.html

Jonathan, & Tandean, V. A. (2016). Pengaruh Tax Avoidance Terhadap Nilai Perusahaan Dengan Profitabilitas Sebagai Variabel Pemoderasi. Proceeding SENDI_U. www.idx.co.id

Mulyani, S. (2014). Pengaruh Karakteristik Perusahaan, Koneksi Politik Dan Reformasi Perpajakan Terhadap Penghindaran Pajak (Studi Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Tahun 2008-2012) [Skripsi]. Universitas Brawijaya.

Nila, L., & Suryanawa, I. K. (2018). Pengaruh Profitabilitas dan Ukuran Perusahaan Terhadap Nilai Perusahaan dengan Pengungkapan Corporate Social Responsibility Sebagai Pemoderasi. E-Jurnal Akuntansi, 23(3), 2145–2174. https://doi.org/https://doi.org/10.24843/EJA.2018.v23.i09.p20

Nugraha, M. C. J., & Setiawan, P. E. (2019). Pengaruh Penghindaran Pajak (Tax Avoidance) Pada Nilai Perusahaan Dengan Transparansi Sebagai Variabel Pemoderasi. E-Jurnal Akuntansi, 1, 398. https://doi.org/10.24843/eja.2019.v26.i01.p15

Prasiwi, K. W. (2015). Pengaruh Penghindaran Pajak Terhadap Nilai Perusahaan: Transparansi Informasi Sebagai Variabel Pemoderasi [Skripsi]. Universitas Diponegoro.

Rusydi, M. K. (2014). Pengaruh ukuran perusahaan terhadap aggressive tax avoidance di indonesia. Jurnal Akuntansi Multiparadigma, 4(2), 323-329.

Sartika, D., & Fidiana. (2015). Moderasi Kepemilikan Institusional Terhadap Hubungan Perencanaan Pajak Nilai Perusahaan Dengan. Jurnal Ilmu & Riset Akuntansi, 4(12).

Simarmata, A. P. P., & Cahyonowati, N. (2014). Pengaruh Tax Avoidance Jangka Panjang Terhadap Nilai Perusahaan Dengan Kepemilikan Institusional Sebagai Variabel Pemoderasi (Studi Empiris Pada Perusahaan Manufaktur Yang Terdaftar Di Bei Periode 2011-2012). Diponegoro Journal of Accounting, 3(3), 1–13. http://ejournal-s1.undip.ac.id/index.php/accounting

Suandy, E. (2011). Perencanaan Pajak. Salemba Empat.

Sugiyono. (2013). Statistika Untuk Penelitian. Salemba Empat.

Suryowati, E. (2014, January 24). Ini Alasan Kasus Pajak Asian Agri Digiring ke Pelanggaran Administrasi. Kompas.Com.https://money.kompas.com/read/2014/01/24/1644374/Ini.Alasan.Kasus.Pajak.Asian.Agri.Digiring.ke.Pelanggaran.Administrasi

Victory, G., & Cheisviyani, C. (2016). Pengaruh Tax Avoidance Jangka Panjang Terhadap Nilai Perusahaan Dengan Kepemilikan Institusional Sebagai Variabel Pemoderasi: Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di BEI Tahun 2010-2014. Jurnal WRA, 4(1). https://doi.org/10.24036/wra.v4i1.7219

Wang, X. (2010). Tax Avoidance, Corporate Transparency, and Firm Value. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1716474

Wati, L. N. (2019). Model Corporate Social Responsibility (CSR). Myria Publisher. https://books.google.co.id/books?id=lKPHDwAAQBAJ&printsec=copyright&hl=id&source=gbs_pub_info_r#v=onepage&q&f=false

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.