The Revenue Recognition Based on PSAK 72 in Real Estate Companies Listed on The Indonesia Stock Exchange for 2018 to 2021

DOI:

https://doi.org/10.51967/tanesa.v26i1.3328Keywords:

PSAK 72, Revenue Recognition, Profitability, Real Estate, Financial PerformanceAbstract

This study aims to examine the impact of implementing PSAK 72 on revenue recognition within the Indonesian real estate sector. Using a comparative descriptive method with a quantitative approach, this research analyzed seven major real estate companies listed on the Indonesia Stock Exchange from 2018 to 2021. The results showed variations in financial performance indicators such as Gross Profit Margin (GPM), Net Profit Margin (NPM), Return on Assets (ROA), and Return on Equity (ROE) before and after the implementation of PSAK 72. The findings indicate that the standard significantly influences financial reporting and profitability due to stricter revenue recognition criteria. This research provides insights into the practical effects of PSAK 72 for stakeholders in the real estate industry.

References

Amyulianthy, R., Rahmat, A., & Munira, A. (2022). Analisis Dampak PSAK 72 terhadap Pengambilan Keputusan Investasi. Jurnal Akuntansi dan Keuangan, 14(1), 45–58.

Anjani, P. (2023). Enhancing Transparency and Trust through Effective Financial Statement Audits. Advances in Managerial Auditing Research, 1(3). https://doi.org/10.60079/amar.v1i3.228

Arifin, Z., Sarita, B., & Madi, A. (2019). Pengaruh Likuiditas, Leverage, Ukuran Perusahaan dan Pertumbuhan Penjualan terhadap Profitabilitas Perusahaan Properti dan Real Estate. Jurnal Ekonomi dan Bisnis, 8(2), 89–101.

Casnila, L., & Nurfitriana, R. (2020). Penerapan PSAK 72 dan Pengaruhnya terhadap Debt to Equity Ratio pada Perusahaan Real Estat. Jurnal Akuntansi Multiparadigma, 11(1), 122–134.

Halim, A., & Herawati, N. (2020). Dampak Implementasi PSAK 72 terhadap Pelaporan Keuangan Perusahaan Real Estate. Jurnal Riset Akuntansi Kontemporer, 12(3), 199–210.

Ikatan Akuntan Indonesia. (2018). Pernyataan Standar Akuntansi Keuangan (PSAK) No. 72: Pendapatan dari Kontrak dengan Pelanggan. Jakarta: IAI.

Ikatan Akuntan Indonesia. (2020). Standar Akuntansi Keuangan. Jakarta: IAI.

Izzah, N., Richmayati, M., & Sandra, E. (2024). Pengaruh Current Ratio, Debt To Equity Ratio, dan Net Profit Margin Terhadap Pertumbuhan Laba. Jurnal Liga Ilmu Serantau, 1(2), 78–92. https://doi.org/10.36352/jlis.v1i2.874

Mandasari, F. E., & Rahardja, L. (2022). Effect of Implementation of PSAK 72, ROA, Company Size on Company Value in LQ-45 Indexed Companies. The Accounting Journal of Binaniaga, 7(2), 219–230. https://doi.org/10.33062/ajb.v7i2.6

Masril, M., Yusuf, M., & Novianti, D. (2024). The Effect of Recognition of Revenue, Contract Liabilities and Contract Assets Under Psak 72 on Financial Performance of Telecommunication Companies Listed on The Idx for The 2015-2020 Period. Jurnal Akuntansi, Manajemen, Bisnis Dan Teknologi, 4(2), 191–200. https://doi.org/10.56870/9ehqs609

Maulidya, R., & Agustin, E. (2019). Pengaruh Rasio Profitabilitas terhadap Perubahan Laba pada Perusahaan Properti dan Real Estate. Jurnal Ilmu Manajemen, 7(1), 67–78.

Mustiko, S., & Putra, D. (2022). Kesiapan Perusahaan Real Estat dalam Implementasi PSAK 72. Jurnal Akuntansi dan Teknologi Informasi, 15(2), 110–123.

Nur Rachmania, & Retno Fuji Oktaviani. (2024). Pengaruh Current Ratio, Total Asset Turnover, Return on Equity dan Net Profit Margin terhadap Pertumbuhan Laba. Jurnal Riset Manajemen, 2(3), 320–333. https://doi.org/10.54066/jurma.v2i3.2275

Panggabean, M. S., Angelica, A., Aprilia, D. K., Wijaya, E., & Febriani, S. (2021). Pengaruh Net Profit Margin, Return On Assets, Debt To Equity Ratio Dan Ito Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia. Journal of Economic, Bussines and Accounting (COSTING), 5(1), 132–139. https://doi.org/10.31539/costing.v5i1.2600

Philana, R., & Hidayat, M. A. (2023). Pengaruh Profitabilitas terhadap Nilai Perusahaan di Sektor Properti dan Real Estate. Jurnal Akuntansi & Keuangan, 18(1), 34–47.

Setiani, T., & Accacia Qonita Andini, R. (2023). Pengaruh Rasio Solvabilitas dan Rasio Aktivitas Perusahaan Terhadap Rasio Profitabilitas Perusahaan Pada Subsektor Makanan dan Minuman yang Terdaftar di Bursa Efek Indonesia Periode 2020-2023. Jurnal Akuntansi, 18(02), 68–81. https://doi.org/10.58457/akuntansi.v18i02.3448

Shabrina, N. (2019). Analisis Rasio Profitabilitas dan Rasio Likuiditas untuk Menilai Kinerja Keuangan Keuangan pada PT. Astra Internasional,TBK. JIMF (Jurnal Ilmiah Manajemen Forkamma), 2(3). https://doi.org/10.32493/frkm.v2i3.3398

Suciati, R., Rialmi, Z., & Nastiti, H. (2021). Relationship Analysis of Capital Structure and Profitability Ratio in Trade Sector Companies in Indonesia. 2(1). https://doi.org/10.38035/jafm.v2i1

Veronica, M., Lestari, D., & Metekohy, W. (2019). Analisis Penerapan PSAK 72 terhadap Laporan Keuangan dan Rasio Likuiditas Perusahaan. Jurnal Akuntansi Indonesia, 8(1), 75–90.

Wigiyanti, H., & Basyir, A. (2024). Dampak PSAK 72 terhadap Kinerja Keuangan PT Ciputra Development Tbk. Jurnal Ekonomi dan Keuangan, 10(2), 140–152.

Wiliana, E. (2019). Implikasi Penggantian PSAK Lama oleh PSAK 72 dalam Pelaporan Pendapatan. Jurnal Riset Akuntansi dan Keuangan, 6(1), 33–46.

Yarnanda, S., Tanjaya, V., Sinurat, R. L., & Muda, I. (2024). The Comparison of Revenue Recognition under IFRS 15, ASC 606, PSAK 72 and Its Implementation on Revenue Recognition of PT Telkom Indonesia Tbk. Brazilian Journal of Development, 10(1), 131–147. https://doi.org/10.34117/bjdv10n1-009

Downloads

Published

How to Cite

Issue

Section

License

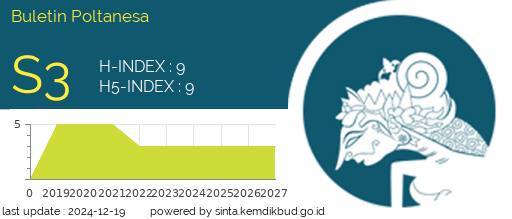

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.