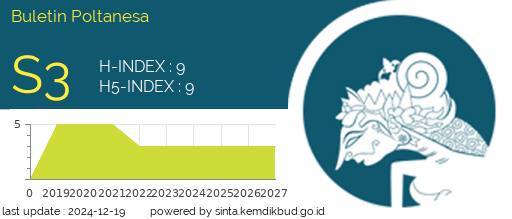

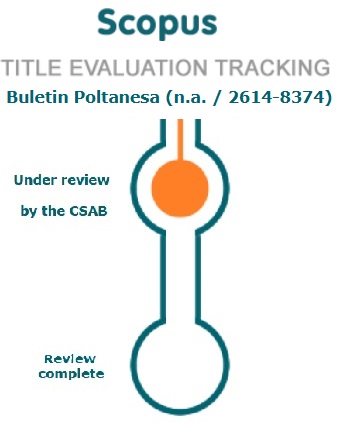

Data Quality Risk Management in the Data Quality Issue Management System at Private Banking Using the OCTAVE Allegro Approach

DOI:

https://doi.org/10.51967/tanesa.v26i1.3312Keywords:

Banking, Data Quality, OCTAVE Allegro, Risk Management, SecurityAbstract

The success of a private bank is significantly dependent on managing the data quality efficiently so that the operations can run effectively, ensure compliance with regulations, and make its customers happy. Having poor data quality can also result in some pretty major monetary losses, operational inefficiencies, or damage to your reputation. This paper explores the application of the OCTAVE Allegro approach within a Supply Chain Data Quality Issue Management System, to deal with these challenges. The use of an information security risk assessment tool such as OCTAVE Allegro enforces a structured method to gather, analyze, and prioritize data quality risks. It details the benefits of its approach — greater risk comprehension, more effective mitigation strategies, and adherence to industry norms. Using this framework, banks can improve decision-making, enforce data governance policies as well as prevent more serious and costlier data-related errors. Implementation challenges such as how to make OCTAVE Allegro applicable to external requirements, and organizational resistance are explored, and this leads to an evaluation of the proposed strategies. In the end, this paper shows that the implementation of OCTAVE Allegro effectively helps private banks construct a safe and trustworthy data ecosystem. The approach enhances how the process supports improved data quality risk management and ultimately success in a growingly data-centered sector.

References

Abidin, R. Z., Sulaiman, M. S., & Yusoff, N. (2017). Erosion risk assessment: A case study of the Langat River bank in Malaysia. International Soil and Water Conservation Research, 5(1). https://doi.org/10.1016/j.iswcr.2017.01.002

Alfarisi, S., & Surantha, N. (2022). Risk assessment in fleet management system using OCTAVE allegro. Bulletin of Electrical Engineering and Informatics, 11(1). https://doi.org/10.11591/eei.v11i1.3241

Aryanti, U., Anwar, Moch. T., & Rahmawati, T. (2023). INFORMATION SECURITY RISK MANAGEMENT USING OCTAVE ALLEGRO METHOD AT UNIVERSITY. International Journal of Ethno-Sciences and Education Research, 3(4). https://doi.org/10.46336/ijeer.v3i4.506

Azhari, A. R., & Riadi, I. (2023). Risk Assessment Analysis Website on Tech Company using OCTAVE Allegro Framework. International Journal of Computer Applications, 185(28). https://doi.org/10.5120/ijca2023923031

Bruno, E., Iacoviello, G., & Lazzini, A. (2017). Data quality and data management in banking industry. Empirical evidence from small Italian banks. In Lecture Notes in Information Systems and Organisation (Vol. 20). https://doi.org/10.1007/978-3-319-49538-5_2

Gerardo, V., & Fajar, A. N. (2022). Academic IS Risk Management using OCTAVE Allegro in Educational Institution. Journal of Information Systems and Informatics, 4(3). https://doi.org/10.51519/journalisi.v4i3.319

Günther, L. C., Colangelo, E., Wiendahl, H. H., & Bauer, C. (2019). Data quality assessment for improved decision-making: A methodology for small and medium-sized enterprises. Procedia Manufacturing, 29. https://doi.org/10.1016/j.promfg.2019.02.114

Irsheid, A., Murad, A., Alnajdawi, M., & Qusef, A. (2022). Information security risk management models for cloud hosted systems: A comparative study. Procedia Computer Science, 204. https://doi.org/10.1016/j.procs.2022.08.025

Mogos, G., & Mohd Jamail, N. S. (2020). Study on security risks of e-banking system. Indonesian Journal of Electrical Engineering and Computer Science, 21(2). https://doi.org/10.11591/ijeecs.v21.i2.pp1065-1072

P.-H. Nguyen et al., “Assessing cybersecurity risks and prioritizing top strategies in Vietnam’s finance and banking system using strategic decision-making models-based neutrosophic sets and Z number,” Heliyon, vol. 10, no. 19, Oct. 2024. https://doi:10.1016/j.heliyon.2024.e37893

Sanjaya, J. (2020). Analisis Risk Assessment Terhadap Perusahaan IT di Bidang Finansial Menggunakan OCTAVE Allegro Framework. Inspiration: Jurnal Teknologi Informasi Dan Komunikasi, 10(1). https://doi.org/10.35585/inspir.v10i1.2528

Suroso, J. S., & Fakhrozi, M. A. (2018). Assessment of Information System Risk Management with Octave Allegro at Education Institution. Procedia Computer Science, 135. https://doi.org/10.1016/j.procs.2018.08.167

Suroso, J. S., Januanto, A., & Retnowardhani, A. (2019). Risk Management of Debtor Information System at Bank XYZ Using OCTAVE Allegro Method. Proceedings of the International Conference on Electrical Engineering and Informatics, 2019-July. https://doi.org/10.1109/ICEEI47359.2019.8988890

Wagiu, E. B., Siregar, R., & Maulany, R. (2019). Information System Security Risk Management Analysis in Universitas Advent Indonesia Using Octave Allegro Method. Abstract Proceedings International Scholars Conference, 7(1). https://doi.org/10.35974/isc.v7i1.1387

Borman, W. C., Hanson, M. A., Oppler, S. H., Pulakos, E. D., & White, L. A. (2020). Role of early supervisory experience in supervisor performance. Journal of Applied Psychology, 78(3), 443-449. https://doi.org/10.1037/0021-9010.78.3.443

Wiskunde, B., Arslan, M., Fischer, P., Nowak, L., Van den Berg, Kovács, A. (2019). Indie pop rocks mathematics: Twenty One Pilots, Nicolas Bourbaki, and the empty set. Journal of Improbable Mathematics, 27(1), 1935–1968. https://doi.org/10.0000/3mp7y-537

Vogels, A. G. C., Crone, M. R., Hoekstra, F., & Reijneveld, S. A. (2012). Comparing three short questionnaires to detect psychosocial dysfunction among primary school children: a randomized method. BMC Public Health, 9(1), 489. https://doi.org/10.1186/1471-2458-9-489

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.