Analysis of the Influence of Third Party Funds, Capital Adequacy, and Credit Distribution on Banking Profitability with Operational Efficiency as a Moderating Variable

DOI:

https://doi.org/10.51967/tanesa.v26i1.3311Keywords:

Third Party Funds, Capital Adequacy, Credit Distribution, Operational Efficiency, ProfitabilityAbstract

This study aims to analyze the effect of Third Party Funds (TPF), Capital Adequacy, and Credit Distribution on banking profitability, with Operational Efficiency as a moderating variable. This study uses a quantitative approach with secondary data from the financial statements of Regional Development Banks (BPD) during the period 2021–2023, namely the post-COVID-19 pandemic period. Data processing was carried out using the SPSS version 25 application. The results of the study showed that TPF did not have a significant effect on profitability, indicating that the amount of funds collected was not necessarily accompanied by the effectiveness of their utilization. On the other hand, Capital Adequacy and Credit Distribution were proven to have a significant effect on bank profitability. Operational Efficiency acts as a moderating variable that strengthens the relationship between Capital Adequacy and profitability, but is unable to moderate the effect of TPF or Credit Distribution. This finding supports the Signaling Theory, which states that capital adequacy and operational efficiency can be positive signals for bank performance, especially in the context of post-pandemic economic recovery.

References

Arief, R. (2023). Peran Bank Pembangunan Daerah dalam Mendorong Inklusi Keuangan di Wilayah Terpencil. Jakarta: Penerbit Ekonomi Nusantara.

Brigham, E. F., & Houston, J. F. (2019). Fundamentals of Financial Management (15th ed.). Cengage Learning.

Chase, Richard B., F. Robert Jacobs, Nicholas J. Aquilano. (2006). Operations management for competitive advantage 11 th edition. Universitas Indiana: McGraw-Hill/Irwin.

Edo, D. S., & Wiagustini, N. L. (2014). "Pengaruh Dana Pihak Ketiga, Non-Performing Loan, Dan Capital Adequacy Ratio Terhadap Loan To Deposit Ratio Dan Return On Assets Pada Sektor Perbankan Di Bursa Efek Indonesia". E-Jurnal Ekonomi dan Bisnis Universitas Udayana, halaman 650-673.

Fitriani, R., & Prasetyo, A. (2021). Pengaruh Penyaluran Kredit terhadap Profitabilitas Perbankan di Indonesia. Jurnal Ekonomi dan Perbankan, 9(2), 112–123.

Ghozali. (2016). Aplikasi Analisis Multivariete Dengan Program IBM SPSS. Semarang: Badan Penerbit Universitas Diponegoro.

Hanafi, M. M. (2012). Manajemen Keuangan (Edisi Pertama). Yogyakarta: BPFE-Yogyakarta.

Haryanto, A. (2021). Analisis Pengaruh BOPO terhadap Profitabilitas Bank di Indonesia. Jurnal Keuangan dan Perbankan, 25(1), 88–97.

Haryanto, D. (2020). Analisis Pengaruh Dana Pihak Ketiga terhadap Profitabilitas pada Bank Umum di Indonesia. Jurnal Akuntansi dan Keuangan Daerah, 12(1), 45–58.

Heizer, Jay & Barry. Render. (2006). Manajemen Operasi, Jilid I; diterjemahkan oleh: Setyoningsih,D., dan Almahdy,I; Edisi tujuh, Jakarta: Salemba Empat.

Hermawaty, D., & Sudana, I. M. (2023). Manajemen Keuangan Perusahaan. Jakarta: Prenadamedia Group.

Ibrahim, A. (2022). Bank Pembangunan Daerah dan Pemberdayaan Ekonomi Lokal. Yogyakarta: Pustaka Daerah.

Kasmir. (2021). Analisis Laporan Keuangan (Edisi ke-11). Jakarta: RajaGrafindo Persada.

Lestari, A. D., & Supriyanto, E. (2023). Peran Efisiensi Operasional dalam Memoderasi Pengaruh Kecukupan Modal terhadap Profitabilitas. Jurnal Keuangan dan Perbankan, 15(3), 89–102.

Nugroho, H., & Putra, R. (2023). Bank Pembangunan Daerah sebagai Penggerak Ekonomi Regional. Bandung: Lembaga Studi Ekonomi dan Pembangunan.

Noor, M. I. (2015). Manajemen Keuangan dan Penganggaran Perusahaan. Jakarta: Mitra Wacana Media.

Peraturan Otoritas Jasa Keuangan Nomor 4/POJK.03/2016 tentang Penilaian Tingkat Kesehatan Bank Umum. Jakarta.

Putra, I. K. A. (2020). Efisiensi Operasional dan Penyaluran Kredit terhadap Profitabilitas Bank: Studi Empiris pada Bank Konvensional di BEI. Jurnal Ilmu Manajemen, 8(1), 23–34.

Rahayu, S. (2020). Moderasi Efisiensi Operasional terhadap Hubungan Dana Pihak Ketiga dan Profitabilitas Bank. Jurnal Akuntansi dan Keuangan Publik, 5(1), 77–85.

Rahmawati, E., & Nani, S. (2021). Pengaruh Dana Pihak Ketiga, CAR, dan LDR terhadap Profitabilitas Bank. Jurnal Ilmu Ekonomi, 18(3), 45–56.

Rahmawati, L., & Yuliana, R. (2022). Pengaruh Capital Adequacy Ratio (CAR) terhadap Profitabilitas Bank Umum. Jurnal Akuntansi dan Keuangan, 10(4), 134–145.

Sari, D. N., & Fitri, L. (2022). Pengaruh LDR dan BOPO terhadap Profitabilitas Bank Pembangunan Daerah di Indonesia. Jurnal Ekonomi dan Bisnis, 10(1), 56–66.

Sari, M., & Nugroho, B. (2020). Analisis Dana Pihak Ketiga terhadap Profitabilitas Bank Konvensional di Indonesia. Jurnal Ekonomi dan Bisnis, 11(3), 67–75.

Sartono, A. (2022). Manajemen Keuangan: Teori dan Aplikasi (Edisi Revisi). Yogyakarta: BPFE-Yogyakarta.

Spence, M. (1973). Job Market Signaling. The Quarterly Journal of Economics, 87(3), 355–374.

Sugiyono (2019). Metode Penelitian Kuantitatif, Kualitatif, dan R&D. Bandung: Alphabet.

Suryaningsih, R., Yuliana, D., & Pratama, A. (2023). Analisis Faktor-Faktor yang Mempengaruhi Profitabilitas Bank Pembangunan Daerah di Indonesia. Jurnal Riset Ekonomi dan Keuangan Daerah, 9(2), 134–150.

Ubay, M., Nurbaiti, L., & Anggraeni, F. (2024). Pengaruh CAR dan DPK terhadap Profitabilitas Bank Umum. Jurnal Akuntansi dan Keuangan Indonesia, 12(1), 33–42.

Utami, W., & Gumanti, T. A. (2019). Teori Keagenan dan Teori Keuangan. Jakarta: Mitra Wacana Media.

Undang-Undang Republik Indonesia Nomor 10 Tahun 1998 tentang Perbankan. Lembaran Negara Republik Indonesia Tahun 1998 Nomor 182.

Wijaya, F., & Astuti, D. (2021). Pengaruh Dana Pihak Ketiga dan Penyaluran Kredit terhadap Profitabilitas Bank Umum Konvensional. Jurnal Ilmu Ekonomi dan Perbankan, 7(2), 98–109.

Wijaya, K. (2020). Efisiensi Operasional dan Pengaruhnya terhadap Kinerja Keuangan Bank. Jurnal Keuangan dan Perbankan, 24(4), 379–392.

Wijaya, R., & Handayani, S. (2021). Efisiensi Operasional sebagai Variabel Moderasi dalam Hubungan Kredit dan Profitabilitas Bank. Jurnal Keuangan dan Akuntansi Indonesia, 13(1), 51–64.

Downloads

Published

How to Cite

Issue

Section

License

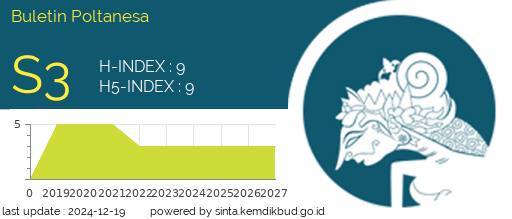

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.