The Effect of Good Corporate Governance on The Value of IDX 30 Companies Listed on The Indonesia Stock Exchange

DOI:

https://doi.org/10.51967/tanesa.v26i1.3310Keywords:

Good Corporate Governance, Audit Committee, Managerial Ownership, Institutional Ownership, Firm ValueAbstract

This study aims to examine the influence of Good Corporate Governance (GCG) on firm value in companies listed in the IDX30 index on the Indonesia Stock Exchange. The background of this research stems from the growing importance of GCG implementation, particularly after the 1997 Asian financial crisis, where internal issues such as weak institutional supervision and poor investment decisions were identified. The study adopts a quantitative approach, utilizing secondary data from annual reports and financial statements of IDX30 companies. Analytical methods include classical assumption tests and multiple regression analysis to determine the effect of GCG variables such as board of commissioners, independent commissioners, audit committee, and institutional ownership on firm value. The results show that GCG practices significantly affect firm value. This finding reinforces the notion that good governance practices enhance transparency, accountability, and stakeholder trust, which are critical in boosting the company's market performance and attractiveness to investors.

References

Alfinur. (2016). Pengaruh Dewan Komisaris Independen terhadap Nilai Perusahaan pada Perusahaan Manufaktur di Bursa Efek Indonesia. Jurnal Ilmu Manajemen, 4(2), 45-56.

Anggraini, T. (2014). Pengaruh Mekanisme Good Corporate Governance terhadap Nilai Perusahaan. Jurnal Akuntansi Multiparadigma, 5(3), 335-348.

Brigham, E. F., & Houston, J. F. (2014). Dasar-dasar manajemen keuangan (11th ed.). Salemba Empat.

Carolina, Y., Wicaksono, R., & Wulandari, D. (2020). Pengaruh Dewan Direksi terhadap Nilai Perusahaan pada Perusahaan Sektor Keuangan di BEI. Jurnal Riset Keuangan dan Akuntansi, 6(1), 12–23.

Centre for European Policy Studies (CEPS). (n.d.). Corporate governance principles and recommendations. Brussels: CEPS.

Dinar Nurfaza, D., Raharjo, K., & Haryono, U. (2017). Pengaruh Kepemilikan Manajerial terhadap Nilai Perusahaan. Jurnal Ilmu Ekonomi dan Manajemen, 2(3), 61–72.

FCGI. (2001). Corporate Governance: Tata Kelola Perusahaan. Jakarta: Forum for Corporate Governance in Indonesia.

Hapsari, L. A., & Fitriany. (2023). Analisis price earning ratio sebagai indikator nilai perusahaan. Jurnal Akuntansi Multiparadigma, 14(2), 101–116.

Hidayat, R., & Fauziah, N. (2024). Pengaruh PBV terhadap keputusan investasi di pasar modal. Jurnal Manajemen Keuangan, 19(1), 22–31.

Hidayat, R., & Prasetyo, A. (2023). Hubungan Good Corporate Governance dan Kinerja Keuangan Perusahaan. Jurnal Ekonomi dan Bisnis Terapan, 14(1), 75-89. https://doi.org/10.29244/jebt.2023.14.1.75-89

Isnin, M. (2015). Pengaruh Komite Audit terhadap Nilai Perusahaan. Jurnal Ilmiah Akuntansi dan Humanika, 5(1), 65–73.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3(4), 305–360.

Jogiyanto, H. (2015). Teori portofolio dan analisis investasi (10th ed.). BPFE-Yogyakarta.

Lestari, D., & Puspitasari, E. (2022). Pengaruh kepemilikan manajerial terhadap nilai perusahaan. Jurnal Ilmiah Akuntansi dan Bisnis, 17(3), 255–263.

Maharani, A. D., & Suprayogi, S. (2023). Determinan nilai perusahaan: Perspektif investor. Jurnal Keuangan dan Bisnis, 21(1), 45–59.

Margaretha, F. (2014). Manajemen keuangan. Erlangga.

Marini, S., & Marina, A. (2017). Pengaruh Dewan Direksi terhadap Nilai Perusahaan. Jurnal Akuntansi Multiparadigma, 8(1), 115–129.

Morris, R. D. (1987). Signalling, agency theory and accounting policy choice. Accounting and Business Research, 18(69), 47–56.

Ningtyas, R., Suhadak, & Nuzula, N. F. (2014). Pengaruh Komite Audit terhadap Nilai Perusahaan. Jurnal Administrasi Bisnis, 10(1), 1–10.

Nugroho, A. B. (2017). Teori agensi dan mekanisme corporate governance dalam meningkatkan kinerja perusahaan. Jurnal Akuntansi Multiparadigma, 8(2), 230–240.

Nugroho, A., & Dewi, R. (2023). Kepemilikan institusional dan pengaruhnya terhadap nilai perusahaan. Jurnal Riset Ekonomi dan Bisnis, 11(2), 80–90.

Nurkhin, A., Syahdan, M., & Anwar, K. (2017). Pengaruh Kepemilikan Institusional terhadap Nilai Perusahaan. Jurnal Akuntansi dan Auditing, 13(1), 55–63.

Nuryono, H., Tisnawati, N., & Aulia, S. (2019). Pengaruh Dewan Komisaris Independen terhadap Nilai Perusahaan. Jurnal Keuangan dan Perbankan, 23(2), 190–202.

OECD. (2023). G20/OECD principles of corporate governance. OECD Publishing.

Oktavia, A., & Sutrisno. (2022). Implementasi prinsip GCG pada perusahaan publik. Jurnal Tata Kelola dan Akuntabilitas Keuangan Negara, 8(2), 140–153.

Perdana, A. P. (2014). Pengaruh Komite Audit dan Kepemilikan Manajerial terhadap Nilai Perusahaan. Jurnal Riset Akuntansi dan Keuangan, 2(1), 30–40.

Putra, A., & Kusuma, R. (2019). Teori Sinyal dalam Konteks Tata Kelola Perusahaan dan Pengaruhnya terhadap Kepercayaan Investor. Jurnal Ekonomi dan Bisnis Terapan, 11(3), 210-222. https://doi.org/10.34567/jebt.v11i3.2345

Putra, M. A. (2016). Pengaruh Struktur Good Corporate Governance terhadap Nilai Perusahaan. Jurnal Akuntansi, 10(2), 155–167.

Putri, A. D., Haryanto, A., & Wulandari, S. (2021). Prinsip-Prinsip Good Corporate Governance dalam Pengambilan Keputusan Perusahaan. Jurnal Akuntansi dan Bisnis, 18(1), 45-60. https://doi.org/10.33005/jab.v18i1.1234

Rahmawati, Y., Sari, D., & Permana, M. (2017). Peran jumlah dewan direksi dalam meningkatkan kinerja perusahaan. Jurnal Ilmu dan Riset Manajemen, 6(8), 1–14.

Retno, R., & Prihatinah, D. (2012). Pengaruh Good Corporate Governance dan Pengungkapan Corporate Social Responsibility terhadap Nilai Perusahaan. Jurnal Nominal, 1(1), 1–16.

Rahman, F., Sari, M., & Pratama, A. (2022). Mekanisme Pengendalian Internal dalam Mendukung Tata Kelola Perusahaan. Jurnal Sistem Informasi Akuntansi, 11(1), 1-15. https://doi.org/10.20961/jsia.v11i1.3450

Rahmawati, D., & Santoso, B. (2021). Peran Dewan Komisaris Independen dalam Penyelesaian Konflik dan Pengawasan Manajemen. Jurnal Manajemen dan Bisnis Indonesia, 17(1), 56-70. https://doi.org/10.23456/jmbi.v17i1.5678

Rahmawati, Y., Sari, D., & Permana, M. (2017). Peran jumlah dewan direksi dalam meningkatkan kinerja perusahaan. Jurnal Ilmu dan Riset Manajemen, 6(8), 1–14.

Santoso, E., & Yulianto, B. (2019). Dampak Implementasi GCG terhadap Nilai Perusahaan di Bursa Efek Indonesia. Jurnal Keuangan dan Perbankan, 23(3), 310-324. https://doi.org/10.26905/jkp.v23i3.3471

Sari, D. P., & Nugroho, S. (2021). Evaluasi Penerapan Good Corporate Governance pada Perusahaan BUMN di Indonesia. Jurnal Administrasi Bisnis, 9(2), 143-154. https://doi.org/10.14710/jab.v9i2.3456

Sari, Y. (2017). Good Corporate Governance dan Nilai Perusahaan: Perspektif Investor. Jurnal Manajemen Bisnis, 9(1), 22–30.

Setiawan, D., & Setiadi, B. (2020). Peran komisaris independen dalam pengawasan manajemen perusahaan. Jurnal Ilmu Manajemen, 18(1), 34–48.

Sianturi, R. F., & Ratnaningsih, S. (2016). Pengaruh Komite Audit terhadap Nilai Perusahaan pada Sektor Properti. Jurnal Riset Ekonomi dan Manajemen, 5(3), 200–210.

Spence, M. (2004). Market signaling: Informational transfer in hiring and related processes. Harvard University Press.

Wijayanti, S., & Prasetyo, H. (2020). Pengaruh Komisaris Independen terhadap Efektivitas Pengawasan Perusahaan. Jurnal Akuntansi dan Keuangan, 12(2), 134-145. https://doi.org/10.12345/jak.v12i2.1234

Wiyono, G., Gendro, M., & Kusuma, D. (2017). Analisis Nilai Perusahaan dalam Perspektif Investasi. Jurnal Manajemen Indonesia, 17(3), 190–200.

Yulianto, A., & Suhadak. (2023). Efektivitas komite audit dalam meningkatkan kualitas pengawasan perusahaan. Jurnal Akuntansi dan Keuangan, 25(2), 110–123.

Yuniati, E., Siregar, S. V., & Rachmawati, W. (2016). Pengaruh kepemilikan institusional terhadap praktik manajemen laba. Jurnal Akuntansi dan Investasi, 17(1), 52–66.

Yosephu, A., Mustikowati, R., & Haryanto, S. (2020). Pengaruh Komite Audit terhadap Nilai Perusahaan pada Perusahaan Manufaktur di BEI. Jurnal Riset Akuntansi dan Keuangan, 8(1), 55–63.

Downloads

Published

How to Cite

Issue

Section

License

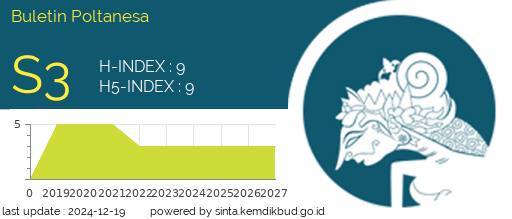

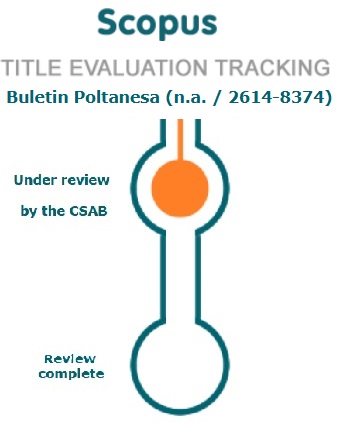

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.