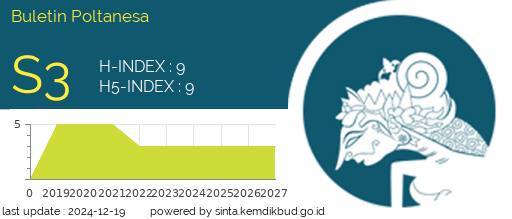

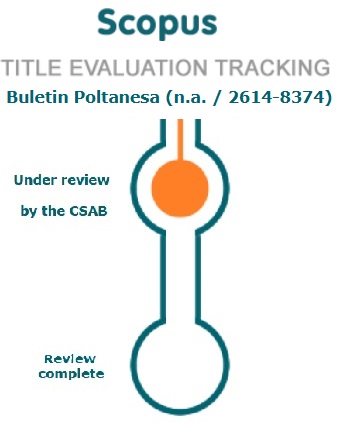

Determinants of Transfer Pricing in Energy Sector Companies with Managerial Ownership as a Moderation

DOI:

https://doi.org/10.51967/tanesa.v26i1.3305Keywords:

Leverage, Profitability, Transfer Pricing, Managerial Ownership.Abstract

The purpose of this research is to analyze the effect of leverage and profitability on transfer pricing with manajerial ownership as the moderating variable. The population in this research were energy sector companies listed on the Indonesia Stock Exchange during the period 2019-2023. The sampling method used was purposive sampling, the overall sample used in this study was 175 annual financial report from 35 companies. The findings reveal profitability do not have a significant effect on transfer pricing, leverage and manajerial ownership have a significant effect on transfer pricing, but manajerial ownership can not significantly moderate the relationship between profitability and transfer pricing

References

Alkurdi, A., Hamad, A., Thneibat, H., & Elmarzouky, M. (2021). Ownership structure’s effect on financial performance: An empirical analysis of Jordanian listed firms. Cogent Business & Management, 8(1), 1939930.

Brigham, E. F., & Houston, J. F. (2011). Dasar-dasar manajemen keuangan: Essentials of financial management (Edisi ke-11, Buku 2). Jakarta Selatan: Salemba Empat.

Devita, H., & Sholikhah, B. (2021). Accounting Analysis Journal The Determinants of Transfer Pricing in Multinational Companies Article Info Abstract. Accounting Analysis Journal, 10(2), 17–23. https://doi.org/10.15294/aaj.v10i2.45941

Dewi, K. S., & Yasa, G. W. (2020). The Effects of Executive and Company Characteristics on Tax Aggressiveness. Jurnal Ilmiah Akuntansi Dan Bisnis, 15(2),280.https://doi.org/10.24843/jiab.2020.v15.i02.p10

Ghozali, I., & Ratmono, D. (2013). Analisis multivariat dan ekonometrika dengan Eviews 10. Badan Penerbit Universitas Diponegoro.

Gunadi. (2007). Pajak Internasional Edisi Revisi (2007). Jakarta: Fakultas Ekonomi Universitas Indonesia.

Jensen, M. C., & Meckling, W. H. (1976). Theory of The Firm: Managerial Behaviour Agency Cost and Ownership Structure. Journal of Financial Economics, 3, 305–360.

Kasmir. (2010). Pengantar Manajemen Keuangan. Edisi ke-5. Jakarta: PT Raja Grafindo Persada.

Kasmir. (2016). Analisis Laporan Keuangan. Jakarta : PT. Raja Grafindo Persada

Kosmaryati, K., Daryanto, W. M., & Situmorang, M. (2019). Pengaruh Penghindaran Pajak, Ukuran Perusahaan, dan Leverage terhadap Nilai Perusahaan dengan Transparansi sebagai Variabel Moderasi. Jurnal Ilmu dan Riset Akuntansi, 8(6), 1–20.

Kurniawan, Anang Muay. (2010). Transfer Pricing: Metode Penentuan Harga Transfer dan Implikasinya Terhadap Pajak Penghasilan. Jakarta: Penerbit Salemba Empat.

Lusiani, S., & Khafid, M. (2022). Pengaruh Profitabilitas, Sturktur Modal dan Ukuran Perusahaan terhadap Kualitas Laba dengan Kepemilikan Manajerial sebagai Variabel Moderating. Owner, 6(1), 1043–1055. https://doi.org/10.33395/owner.v6i1.719

Manik,J., & Darmansyah, D. (2022). Determinan Penghindaran Pajak dengan Profitabilitas Sebagai Pemoderasi pada Perusahaan Manufaktur. Jurnal Riset Akuntansi & Perpajakan (JRAP), 9(02), 146–158. https://doi.org/10.35838/jrap.2022.009.02.12

Organisation for Economic Co-operation and Development. (2020). OECD transfer pricing guidelines for multinational enterprises and tax administrations 2020. OECD

Sari, N. P., & Khafid, M. (2020). Peran Kepemilikan Manajerial dalam Memoderasi Pengaruh Profitabilitas, Leverage, Ukuran Perusahaan, Kebijakan Dividen Terhadap Manajemen Laba pada Perusahaan BUMN. Jurnal Akuntansi Dan Keuangan, 7(2). http://ejournal.bsi.ac.id/ejurnal/index.php/moneter222

Subramanyam, K. R., & Wild, J. J. (2005). Financial statement analysis (9th ed.). McGraw-Hill/Irwin.

Suryana, Anandita B. (2012). Menangkal Kecurangan Transfer Pricing. http://www. Pajak.go.id/node/4049? Lang=en,04 April 2025

Tanjaya, C., & Nazir, N. (2021). Pengaruh Profitabilitas, Leverage, Pertumbuhan Penjualan, Dan Ukuran Perusahaan Terhadap Penghindaran Pajak Pada Perusahaan Manufaktur Sektor Barang Konsumsi Yang Terdaftar Di Bei Tahun 2015-2019. Jurnal Akuntansi Trisakti, 8(2), 189–208. Https://Doi.Org/10.25105/Jat.V8i2.9260

Tyas, F. C., Dosinta, N. F., & Astarani, J. (2024). Determinants Of Tax Avoidance In Lq45 Companies With Company Size As A Moderation. Jurnal Aplikasi Akuntansi,9(1),107–122. Https://Doi.Org/10.29303/Jaa.V9i1.430

Undang-Undang Republik Indonesia Nomor 36 Tahun 2008 tentang Pajak Penghasilan. Lembaran Negara Republik Indonesia Tahun 2008 Nomor 133.

Watts, R. L., & Zimmerman, J. L. (1986). positive accounting theo_ ry., Englewood Clifis, NJ, prentice_Hail. Inc. publ., 19g6.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.