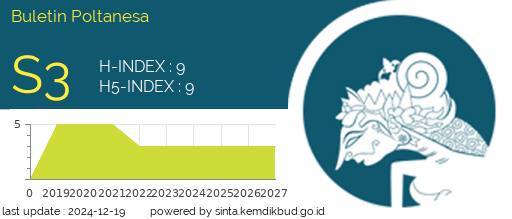

How The Behavioral Intentions of SME Actors: The Relationship Between Financial Literacy and Financial Knowledge With the Mediating Role of Attitude

DOI:

https://doi.org/10.51967/tanesa.v26i1.3291Keywords:

Financial Literacy, Financial Knowledge, Behavioral Intention, SMEsAbstract

This study aimed to explore and understand the behavioral intentions of micro and small business owners in Blitar regarding the use of financial application services. Data were collected using a census sampling technique through an online questionnaire, employing a 5-point Likert scale. A total of 135 respondents, all micro and small business actors in the Blitar area, participated in the survey. Data were processed using SEM-PLS. The results of the study revealed that business actors' actions in managing finances, financial knowledge, and financial literacy do not have a significant influence on behavioral intentions. The behavioral intentions of business actors are still relatively low in determining attitudes, knowledge, and understanding of financial management. This is primarily because their focus lies in marketing and sales. Even though many possess strong financial knowledge, their attitude tends to prioritize managing finances in ways that enhance production, promotion, and market expansion through digital platforms. On the other hand, financial literacy was found to positively influence both financial attitudes and financial knowledge. Financial attitudes can shape investment decisions, especially when supported by financial literacy, which enhances the ability to manage finances and make informed investment choices. Nevertheless, financial literacy does not serve as a moderating factor between financial behavior and financial attitudes in business decision-making

References

Abdallah, W., Tfaily, F., & Harraf, A. (2024). The impact of digital financial literacy on financial behavior: customers’ perspective. Competitiveness Review: An International Business Journal, May. https://doi.org/10.1108/cr-11-2023-0297

Akhyar, C., & Alfajri, U. (2023). The Influence Of Cognitive Finance , Financial Literacy , Financial Planning , And Financial Satisfaction On Stock Investment Behavioral Intentions ( Case Study of Young Entrepreneurs in Lhokseumawe City ). 996–1003.

Aulia, M. R. (2020). Pengaruh Kompetensi Kewirausahaan Terhadap Kinerja Usaha Kedai Kopi Skala Mikro Dan Kecil Di Kota Medan.

Ayu, L., Gladys, L., Wangi, C., Gde, I., & Baskara, K. (2021). the Effect of Financial Attitude, Financial Behavior, Financial Knowledge, and Sociodemographic Factors on Individual Investment Decision Behavior. American Journal of Humanities and Social Sciences Research, 5, 519–527. www.ajhssr.com

Banthia, D., & Dey, S. K. (2022). Impact of Financial Knowledge , Financial Attitude and Financial Behaviour on Financial Literacy : Structural Equitation Modeling Approach. January. https://doi.org/10.13189/ujaf.2022.100133

Behavior, F. (2025). The Influence of Financial Knowledge , Financial Attitude and Personality on Financial Management Behavior of Contemporary Batik Craft MSMEs. 13(2), 195–206. https://doi.org/10.37641/jiakes.v11i2.3191

C., L. D. P. S. E. (2024). Pengaruh Financial Literacy Dan Financial Attitude Terhadap Perilaku Perencanaan.

Chen, J. (2019). User adoption of a hybrid social tagging approach in an online knowledge community approach. https://doi.org/10.1108/AJIM-09-2018-0212

Cigdem, H., & Ozturk, M. (2016). Factors affecting students’ behavioral intention to use LMS at a Turkish post-secondary vocational school. International Review of Research in Open and Distributed Learning, 17(3), 276–295. https://doi.org/10.19173/irrodl.v17i3.2253

Damayanti, D., Tubasuvi, N., Purwidianti, W., & Aryoko, Y. P. (2023). Financial Management Behavior: The Influence of Financial Knowledge, Financial Attitude, and Financial Literacy Mediated by Locus of Control. Indonesian Journal of Business Analytics (IJBA), 3(6), 2331–2350. https://journal.formosapublisher.org/index.php/ijba

Dayanti, F. K., Susyanti, J., & S, M. K. A. B. (2020). Pengaruh Literasi Keuangan, Pengetahuan Keuangan Dan Sikap Keuangan Terhadap Perilaku Manajemen Keuangan Pada Pelaku Usaha UMKM Fashion Di Di Kabupaten Malang. E – Jurnal Riset Manajemen Prodi Manajemen, 51(1), 51.

Ertiro, M. A. (2019). Financial Literacy Levels of Medium and Small Scale Businesses Owners and its Correlation with Firms ’ Operating Performance : in Case of Hossana Town International Journal of Sciences : Basic and Applied Research Financial Literacy Levels of Medium and S. International Journal of Sciences: Basic and Applied Research, 48(4), 224–248. https://www.researchgate.net/publication/338544294_Financial_Literacy_Levels_of_Medium_and_Small_Scale_Businesses_Owners_and_its_Correlation_with_Firms’_Operating_Performance_in_Case_of_Hossana_Town

Estuti, E. P., & , Ika Rosyada, F. F. (2021). Analisis Pengetahuan Keuangan, Kepribadian Dan Sikap Keuangan Terhadap Perilaku Manajemen Keuangan. 9(1), 1–13.

Ghozali, I. (2021). Aplikasi Analisis Multivariate Dengan Program IBM SPSS 26 (10th ed.). Semarang : Badan Penerbit - UNDIP.

Grace Stella Simaremare, A. P. prima. (2024). Pengaruh Financial Knowledge, Financial Behaviourdan Financial Attitudeterhadap Financial Literacy pada Mahasiswa Akuntansi Kota Batam. Scientia Journal, 21–32. https://forum.upbatam.ac.id/index.php/scientia_journal/article/view/9119/3776

Haag, L., & Brahm, T. (2025). The Gender Gap in Economic and Financial Literacy: A Review and Research Agenda. International Journal of Consumer Studies, 49(2). https://doi.org/10.1111/ijcs.70031

Handayani, Putu Wuri, Hidayanto, Achmad Nizar, Pinem, Ave Adriana, Azzahro, Fatimah, Munajat, Q. (2019). Konsep CB-Sem dan Sem-Pls Disertai Dengan Contoh Kasus (1st ed.). PT RAJAGRAFINDO PERSADA. https://books.google.co.id/books?hl=id&lr=&id=MeHeEAAAQBAJ&oi=fnd&pg=PP1&dq=model+perhitungan+sem+pls&ots=DYkVo22GMU&sig=RnwKlXRqYeLJPveeVxWbPP7U4H8&redir_esc=y#v=onepage&q=model perhitungan sem pls&f=false

Ho, C. S. M., & Lee, D. H. L. (2022). Financial Literacy: The Impact of The Foreign‑Language Efect on Risk‑Taking Values, Financial Attitudes, and Behavior of Hong Kong Secondary Students. The Asia-Pacific Education Researcher, April. https://doi.org/10.1007/s40299-022-00670-5

Hutapea, H. D., Manurung, A., & Sitompul, A. S. (2023). The influence of financial attitudes, locus of control, education on financial management behavior with financial literacy as a moderating variable. Management Studies and Entrepreneurship Journal, 4(5), 4800–4810. http://journal.yrpipku.com/index.php/msej

Indrasari, M., Pamuji, E., Prasnowo, M. A., Aziz, M. S., & Nurcahyo, M. S. (2022). Akselerasi Pemanfaatan Aplikasi Pengelolaan Keuangan Digital Sektor UKM di Jawa Timur dan Nusa Tenggara Barat. Prapanca : Jurnal Abdimas, 2(2), 141–148. https://doi.org/10.37826/prapanca.v2i2.404

Kaiser, T., & Lusardi, A. (2024). Financial Literacy and Financial Education: An Overview. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4803857

Koenen, Tabea Bucher, Alessie, Rob, Lusardi, Annamaria, & Rooij, M. van. (2016). Women, Confidence, and Financial Literacy. European Investment Bank, February, 1–36.

Kurtaliqi, F., Lancelot Miltgen, C., Viglia, G., & Pantin-Sohier, G. (2024). Using advanced mixed methods approaches: Combining PLS-SEM and qualitative studies. Journal of Business Research, 172(November 2023). https://doi.org/10.1016/j.jbusres.2023.114464

Latifah, N., Wardani, S. I., & Wahyuningsih, S. D. (2024). Analysis of micro and small business behavior in the adoption of financial applications for the development of an android- based financial application model. Institute of Computer Science (IOCS), 14(1), 138–149.

Laurensia Widyastuti, Suhaidar, A. Y. (2020). Analisis Penerimaan Teknologi Financial Anggregator Cekaja.Com Terhadap Behavior Intention Melalui Pendekatan Teori Perilaku Rencanaan (Theory of Planned Behavior atau TPB). Indonesia Journal of Accounting and Business.

Lestari, B. W., Bintari, W. C., Zain, E. M., Lewenussa, R., Andjar, F. J., & Rawi, R. D. P. (2023). Pelatihan Perencanaan dan Pengelolaan Keuangan Yang Efektif dan Efisien Pada UMKM di Kabupaten Sorong Papua Barat Daya. Journal of Entrepreneurship and Community Innovations (JECI), 1(2), 71–78. https://doi.org/10.33476/jeci.v1i2.60

Listyorini, T., Supriyati, E., & Iqbal, M. (2023). Penerapan Aplikasi Qasir Sebagai Sistem Pencatatan Keuangan Pada Rumah Produksi Batik “Gentamas” Kudus. Abdi Masya, 4(1), 18–28. https://doi.org/10.52561/abma.v4i1.233

Lyons, Angela C., Hanna, J. K. (2021). A methodological overview to defining and measuring “digital” financial literacy. Financial Planning Review, 4(2). https://doi.org/10.1002/cfp2.1113

Marheni, D. K. (2020). Pengaruh Financial Attitude, Financial Education, Financial Knowledge, Financial Experience, Dan Financial Behavior Terhadap Financial Literacy Pada Pelajar Kota Batam. Journal of Global Business and Management Review, 2(1), 21. https://doi.org/10.37253/jgbmr.v2i1.790

Meiranto, W., Farlyagiza, F., Faisal, F., Nur Afri Yuyetta, E., & Puspitasari, E. (2024). The mediating role of behavioral intention on factors influencing user behavior in the E-government state financial application system at the Indonesian Ministry of Finance. Cogent Business and Management, 11(1). https://doi.org/10.1080/23311975.2024.2373341

Min, Y., Yang, M., Huang, J., & Duangekanong, S. (2023). Influencing Factors of Behavior Intention of Master of Arts Students Towards Online Education in Chengdu Public Universities , China. 15(1), 1–10.

Ningsih, M. C., Woestho, C., & Kurniawan, D. (2023). Pengaruh Literasi Keuangan, Manfaat Paylater Dan Pendapatan Generasi Z Terhadap Minat Penggunaan Paylater Di Platfrom Shopee Pada Kecamatan Tambun Selatan. Jurnal Ekonomina, 2(November), 3218–3231.

Nusa, G. H., & Martfiyanto, R. (2021). The effect Of Financial, Knowledge, Behavior and Attitude to Financial Literacy on Accounting Bachelor Students Universitas Jenderal Achmad Yani Yogyakarta. Bilancia: Jurnal Ilmiah Akuntansi, 5(2), 226–237.

Ofosu-Ampong, Kingsley Asmah, Alexander Kani, John Amoako Bibi, D. (2023). Determinants of digital technologies adoption in government census data operations. Digital Transformation and Society, 2(3), 293–315. https://doi.org/10.1108/DTS-11-2022-0056

Pattinaya, L., Ekananda, M., & Mukyanto, A. (2025). Pengaruh Financial Knowledge , Financial Behavior dan Financial Attitude Terhadap Keputusan Investasi Pembelian Rumah Oleh Generasi Z. 6(1), 115–133.

Peni, N., Neng, S., Yayu, S., & Noradiva, H. (2024). Fintech , Financial Knowledge and Performance : Factors That Support The Sustainability of. 01011.

Phyu, K. K., & Vongurai, R. (2020). Impacts On Adaptation Intention Towards Using Accounting Software In Terms Of Technology.

Pramedi, A. D., & Haryono, N. A. (2021). Pengaruh Financial Literacy, Financial Knowledge, Financial Attitude, Income dan Financial Self Efficacy terhadap Financial Management Behavior Entrepreneur Lulusan Perguruan Tinggi di Surabaya. Jurnal Ilmu Manajemen, 9(2), 572. https://doi.org/10.26740/jim.v9n2.p572-586

Rahadi, D. R. (2023). Pengantar Partial Least Squares Structural Equation Model (PLS-SEM) 2023. CV. Lentera Ilmu Madani, Juli, 146.

Raharjo, K., Dalimunte, N. D., Purnomo, N. A., Zen, M., Rachmi, T. N., Sunardi, N., & Zulfitra. (2022). Pemanfaatan Financial Technology dalam Pengelolaan Keuangan pada UMKM di Wilayah Depok. Jurnal Pengabdian Masyarakat Madani (JPMM), 2(1), 67–77. https://doi.org/10.51805/jpmm.v2i1.70

Rahmawati, A., & Aryansah, J. E. (2023). Pengalaman Pengguna (User Experience) Pada Aplikasi Electronic Tax (E-Tax) Di Kota Palembang. Spirit Publik: Jurnal Administrasi Publik, 18(1), 116–126. https://repository.unsri.ac.id/90396/

Rahmawati, N. W., & Haryono, N. A. (2020). Analisis Faktor Yang Memengaruhi Financial Management Behavior Dengan Mediasi Locus of Control. Jurnal Ilmu Manajemen, 8, 549–563. https://ejournal.unesa.ac.id/index.php/jim/article/view/33265

Rai, K., Dua, S., & Yadav, M. (2019). Association of Financial Attitude, Financial Behaviour and Financial Knowledge Towards Financial Literacy: A Structural Equation Modeling Approach. FIIB Business Review, 8(1), 51–60. https://doi.org/10.1177/2319714519826651

Risman, A. (2024). Behavioral Finance of MSME: Digital Finance, Managerial Biases, Financial Literacy. Dinasti International Journal of Economics, Finance & Accounting, 5(2), 641–649. https://doi.org/10.38035/dijefa.v5i2.2660

Roger Bougie, U. S. (2024). Research Methods For Business: A Skill Building Approach.

Sa’diyah, C. (2021). Analysis Of Factors Affecting Adoption Of Financial Technology Application. Sentralisasi, 10(1), 57. https://doi.org/10.33506/sl.v10i1.1208

Sari, A. A., Akuntansi, J., Mataram, U., Sasanti, E. E., Akuntansi, J., & Mataram, U. (2024). Pengaruh Pendapatan , Financial Attitude , Financial Knowledge , Self-Efficiancy , Dan Self-Control Terhadap Mataram. 4(3), 469–488.

Sari, A. W., Purwanto, B., & Viana, E. D. (2023). Literasi keuangan dan faktor yang memengaruhi minat pelaku umkm berinvestasi di pasar modal: analisis theory of planned behavior. INOBIS: Jurnal Inovasi Bisnis Dan Manajemen Indonesia, 6(3), 314–327. https://doi.org/10.31842/jurnalinobis.v6i3.279

Sarstedt, M., Ringle, C. M., & Hair, J. F. (2021). Partial Least Squares Structural Equation Modeling. Handbook of Market Research, November, 587–632. https://doi.org/10.1007/978-3-319-57413-4_15

Siti Rahayu, F., Risman, A., Firdaus, I., & Haningsih, L. (2023). the Behavioral Finance of Msme in Indonesia: Financial Literacy, Financial Technology (Fintech), and Financial Attitudes. International Journal of Digital Entrepreneurship and Business (IDEB), 4(2), 95–107. https://ejournal.jic.ac.id/ideb/

Sorongan, F. A. (2022). The Influence of Behavior Financial and Financial Attitude on Investment Decisions With Financial Literature as Moderating Variable. European Journal of Business and Management Research, 7(1), 265–268. https://doi.org/10.24018/ejbmr.2022.7.1.1291

Susetyo, D. P., & Firmansyah, D. (2023). Literasi Ekonomi, Literasi Keuangan, Literasi Digital dan Perilaku Keuangan di Era Ekonomi Digital. Economics and Digital Business Review, 4(1), 261–279.

Tabita, J., & Marlina, M. A. E. (2023). Pengaruh Financial Literacy Dan Financial Attitude Terhadap Perilaku Perencanaan Keuangan Masa Pensiun Pada Generasi Sandwich Di Surabaya. Media Akuntansi Dan Perpajakan Indonesia, 5(1), 39–56. https://doi.org/10.37715/mapi.v5i1.4165

Upadhyay, N., Upadhyay, S., Abed, S. S., & Dwivedia, Y. K. (2022). Consumer adoption of mobile payment services during COVID-19 : Extending meta-UTAUT with perceived severity and self-efficacy Nitin Upadhyay [ Corresponding author ] Chairperson Integrated Program in Management IT Systems and Analytics Indian Institute of. International Journal of Bank Marketing., 1–47.

Utami, S., & Nesneri, Y. (2024). Pengaruh Pengetahuan Keuangan, Sikap Keuangan, Keyakinan Keuangan, Kepribadian dan Pendapatan Terhadap Perilaku Manajemen Keuangan Pelaku UMKM (Studi Kasus Pada Pelaku Usaha Penjual Kue di Kecamatan Tuah Madani Kota Pekanbaru). Innovative: Journal Of Social Science Research, 4(3), 10836–10847. https://doi.org/10.31004/innovative.v4i3.11292

Utami, V. F., Nurningsih, S., & Saputra, S. E. (2024). Pengaruh Pengetahuan Keuangan Dan Pengetahuan Kewirausahaan Terhadap Kinerja Bisnis UMKM Kuliner Saji Di Kota Padang. Jurnal Ekonomika Dan Bisnis (JEBS), 4(2), 171–179. https://doi.org/10.47233/jebs.v4i2.1633

Venkatesh, V. (2003). User Acceptance Of Information Technology: Toward A Unified View. Management Information Systems Research Center, 27(3), 95–98. https://doi.org/10.1016/j.inoche.2016.03.015

Vindi Kusuma Wardani, C. W., & Wulandari, D. (2024). Investigasi variabel-variabel yang memengaruhi minat penggunaan QRIS oleh mahasiswa: financial literacy sebagai variabel moderasi. Jurnal Ilmu Manajemen, 451–468. https://erepository.uwks.ac.id/17303/8/Jurnal_Vitria Mecing_20420079.pdf

Wang, P. (2023). Pengaruh Literasi Keuangan, Pengelolaan Keuangan, dan Sikap Keuangan Terhadap Perencanaan Dana Pensiun Masyarakat Kota Batam . AKUNESA: JurnalAkuntansi Unesa, Vol 11(no 3), 279–289.

Wardiansyah, D. R., & Indrawati, N. K. (2021). The Influence of Financial Knowledge, Financial Attitude, and Personality on Financial Management Behavior on XYZ Islamic Boarding School Ponorogo. Kinerja, 25(2), 251–269. https://doi.org/10.24002/kinerja.v25i2.4772

Woolley, P. A., Kendall, M. C., Tacvorian, S., & Asher, S. (2024). Integrating a Personal Finance Workshop to Enhance Financial Literacy Among Senior Medical Students: A Single Institution’s Experience. Advances in Medical Education and Practice, 15, 885–891. https://doi.org/10.2147/AMEP.S474002

Wutun, M. B. M. G., Niha, S. S., & Manafe, H. A. (2023). Financial Attitude and Financial Behavior Analysis Towards Student Financial Literacy in Kupang City. Enrichment : Journal of Management.

Xin, Z., Xiao, B., Wang, L., & Xiao, H. (2024). Individuals’ differences in self-assessment: The relationship between subjective and objective financial literacy. Metacognition and Learning, 19(1), 365–379. https://doi.org/10.1007/s11409-024-09375-0

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.