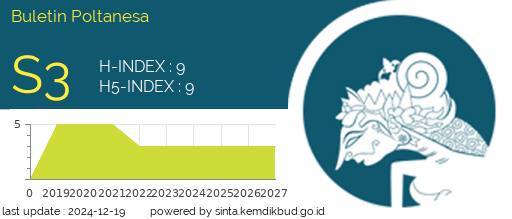

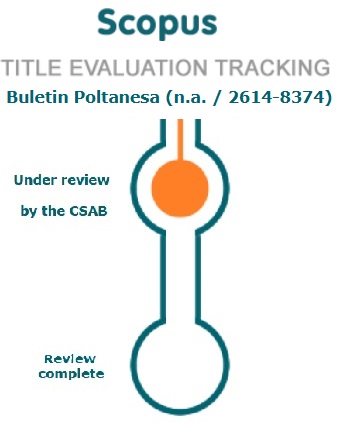

The Influence of PSAK 71 Implementation on Firm Value with Investor Confidence as a Moderating Variable

DOI:

https://doi.org/10.51967/tanesa.v26i1.3286Keywords:

PSAK 71, Allowance for Impairment Losses, Firm Value, Investor Confidence, Banking Sector.Abstract

This study aims to analyze the influence of the implementation of the Indonesian Financial Accounting Standards Statement (PSAK) 71 on firm value, with investor confidence as a moderating variable. The research focuses on banking companies listed on the Indonesia Stock Exchange (IDX) during the 2020–2023 period. A quantitative approach with a causal-comparative research design was employed. The data were analyzed using SPSS version 25.The results indicate that the Allowance for Impairment Losses (CKPN), as a representation of PSAK 71 implementation, has a significant effect on firm value. This is evidenced by a significance value of 0.000 and a t-statistic of -17.685, which exceeds the critical t-value, thereby supporting the first hypothesis. However, investor confidence does not moderate the relationship between CKPN and firm value, as demonstrated by a t-statistic of -0.435, which is below the critical t-value, and a significance level above 0.05. These findings suggest that although CKPN influences market perceptions of risk and corporate valuation, investor confidence is not yet strong enough to mitigate this effect. This study contributes to the understanding of the dynamics surrounding the application of PSAK 71 and market perceptions of financial stability in the banking sector.

References

Dewan Standar Akuntansi Keuangan IAI. (2017). Pernyataan Standar Akuntansi Keuangan (PSAK) No. 71: Instrumen Keuangan. Ikatan Akuntan Indonesia.

Dewi, A. R., & Putra, I. K. (2021). Dampak Implementasi PSAK 71 terhadap Manajemen Risiko Kredit di Perbankan. Jurnal Akuntansi dan Keuangan Indonesia, 18(2), 135-150.

Ferdinand, A. (2002). Structural Equation Modeling dalam Penelitian Manajemen: Aplikasi Model-model Rumit dalam Penelitian untuk Tesis Magister & Disertasi Doktor. Semarang: Badan Penerbit Universitas Diponegoro.

Ghozali, I. (2011). Aplikasi Analisis Multivariate dengan Program IBM SPSS 19. Semarang: Badan Penerbit Universitas Diponegoro.

Ghozali, I. (2016). Aplikasi Analisis Multivariate dengan Program IBM SPSS 23 (Edisi 8). Semarang: Badan Penerbit Universitas Diponegoro.

Gunawan, H., & Setiawan, R. (2022). Pengaruh Penerapan PSAK 71 terhadap Profitabilitas dan Struktur Modal Bank. Jurnal Keuangan dan Perbankan, 26(1), 45-60.

Hair, J. F., Anderson, R. E., Tatham, R. L., & Black, W. C. (1995). Multivariate data analysis (4th ed.). Englewood Cliffs, NJ: Prentice Hall.

Husna, A., & Satria, I. (2020). Pengaruh CKPN terhadap Firm Value: Studi pada Sektor Perbankan. Jurnal Ilmu Akuntansi, 8(2), 95–108.

Ikatan Akuntan Indonesia. (2017). Pernyataan Standar Akuntansi Keuangan (PSAK) No. 71: Instrumen Keuangan.

Ikatan Akuntan Indonesia. (2020). Pernyataan Standar Akuntansi Keuangan (PSAK) 71: Instrumen Keuangan. Jakarta: IAI.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Jogiyanto, H. (2014). Teori Portofolio dan Analisis Investasi (9th ed.). BPFE Yogyakarta.

Rahmawati, L., Kusuma, H., & Widodo, A. (2022). Kepercayaan Investor sebagai Variabel Moderasi dalam Pengaruh PSAK 71 terhadap Firm Value. Jurnal Ekonomi dan Bisnis, 29(3), 210-225.

Sari, M., & Haryanto, A. (2021). Cadangan Kerugian Penurunan Nilai dan Dampaknya terhadap Firm Value. Jurnal Akuntansi dan Keuangan Indonesia, 18(1), 32–44.

Saputra, E., Wijaya, B., & Prasetyo, H. (2021). Implementasi PSAK 71 dan Dampaknya terhadap Firm Value Perbankan. Jurnal Manajemen Keuangan, 19(4), 98-115.

Spence, M. (1973). Job Market Signaling. The Quarterly Journal of Economics, 87(3), 355-374.

Tandelilin, E. (2010). Portofolio dan Investasi: Teori dan Aplikasi. Kanisius.

Wahyuni, S., & Daryanto, W. M. (2022). Peran Kepercayaan Investor dalam Memoderasi Hubungan Kinerja Keuangan terhadap Firm Value. Jurnal Riset Keuangan dan Akuntansi, 13(1), 22–33.

Wijaya, B., & Prasetyo, H. (2023). Peran Kepercayaan Investor dalam Moderasi Dampak PSAK 71 terhadap Harga Saham Perbankan. Jurnal Pasar Modal dan Investasi, 15(2), 178-192.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.