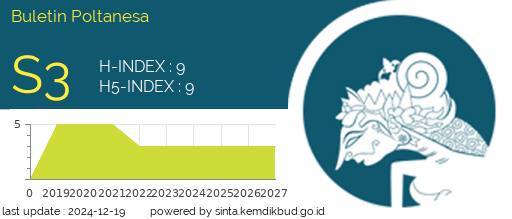

The Role of Investment Opportunity Set (IOS), Firm Age, and Managerial Ownership in Increasing Company Value

DOI:

https://doi.org/10.51967/tanesa.v26i1.3269Keywords:

Investment Opportunity Set, Firm Age, Managerial Ownership, Company ValueAbstract

The value of a company is one of the main considerations for investors when deciding to invest. A high company value reflects positive investor perceptions and indicates that the company has good future prospects. This research aims to analyze the effect of the investment opportunity set, company age, and managerial ownership on firm value. The study was conducted on manufacturing companies in the food and beverage sub-sector listed on the Indonesia Stock Exchange (IDX) for the period 2017 to 2021. The sampling technique used in this study is purposive sampling, where the sample is selected based on specific criteria relevant to the research objectives. As a result, 10 companies that met the criteria were chosen as the sample. The analytical method employed is multiple linear regression analysis, processed using the SPSS Version 26 software. The results of the study indicate that the investment opportunity set and company age do not have a statistically significant influence on firm value. In contrast, managerial ownership has a positive and significant effect on firm value. These findings suggest that the greater the ownership of shares by management, the more aligned management’s interests are with those of shareholders, thereby increasing firm value. The company value can be explained by its independent variables, namely the investment opportunity set, company age, and managerial ownership by 11.3%.

References

Abukosim, Mukhtaruddin, Ferina, I. S., & Nurcahaya, C. (2014). Ownership Structure and Firm Values : Empirical Study on Indonesia Manufacturing Listed Companies. Journal Of Arts, Science & Commerce, V(4), 1–14.

Adam, M., Hakiki, A., Saftiana, Y., & Halimah, D. (2020). Managerial Ownership , Investment Opportunity Set and Firm Value of the Family Companies Listed on Indonesia Stock Exchange. Asian Journal of Accounting and Finance, 2(2), 104–117. http://myjms.moe.gov.my/index.php/ajafin

Akbar, A., Nugraha, Disman, & Waspada, I. (2024). The Mediating Effect of Efficiency on the Impact of Managerial Ownership on Firm Value Moderated by Firm Size and Risk Using Macro PROCESS. International Journal of Atificial Intelegence Research, 8(1).

Andriani, D. A., Kholilla, S., Sitompul, P. H., & Mira. (2022). Pengaruh Return On Asset ( ROA ) Terhadap Nilai Perusahaan Manufaktur yang Terdapat di Bursa Efek Indonesia. Prosiding Seminar Nasional Multidisiplin Ilmu Universitas Asahan Ke-5, 198–206.

Ardianto, C. N. (2023). Nilai Perusahaan : Pengaruh Profitabilitas Dan Good Corporate Governance. Jurnal Ilmiah Manajemen, Ekonomi, & Akuntansi (MEA), 7(2), 1087–1106. https://doi.org/10.31955/mea.v7i2.3118

Berliana, A. T., & Martini. (2024). Pengaruh Struktur Modal, Investment Opportunity Set Dan Kepemilikan Institusional Terhadap Nilai Perusahaan. MENAWAN : Jurnal Riset Dan Publikasi Ilmu Ekonomi, 2(5), 143–154. https://doi.org/10.61132/menawan.v2i5.810

Brigham, E. F., & Houston, J. F. (2019). EBOOK : Fundamentals of Financial Management, 15th edition (15th ed.). Boston : Cengage Learning.

Diah Safitri, Windu Mulyasari, & Nana Nofianti. (2023). The Effect of Managerial Ownership on Firm Value with Accounting Conservatism and Earnings Quality as Intervening Variables. Review of Accounting and Taxation, 2(2), 112–125. https://doi.org/10.61659/reaction.v2i2.170

Fitri Fauziah, & Eddy Winarso. (2023). The Influence of Intellectual Capital Component and Managerial Ownership on Company Value (Case Study of Mining Companies in the Oil and Gas Subsector Listed on the Indonesia Stock Exchange in 2016-2021). Journal of US-China Public Administration, 20(1), 59–81. https://doi.org/10.17265/1548-6591/2023.01.004

Frederica, D. (2019). The Impact of Investment Opportunity Set and Cost of Equity Toward Firm Value Moderated By Information Technology Governance. International Journal of Contemporary Accounting, 1(1), 1–12. https://doi.org/10.25105/ijca.v1i1.5181

Husna, A. (2020). The Effect of Managerial Ownership and Company Size on Firm value with Capital Structure as Moderating Variables in Manufacturing Companies Listed in Indonesia …. Journal of Research in Business, Economics, and Education, 2(5), 1–13.

Indriyati, M., & Prila. (2024). The Effect Of Investment Opportunity Set, Firm Age, Liquidity, And Financial Leverage On Profit Quality In LQ45 Companies In 2018-2022 Prilla Mutia Indriyati Universitas Lampung Usep Syaipudin Universitas Lampung. International Journal of Economics and Management Sciences, 2, 49–66.

Julito, K., & Ticoalu, R. (2022). Firm Value the Moderating Role of Risk Management: Growth, Size, Age, and Profitability. ISCP UTA’45 : International Call for Paper, 87–98. https://doi.org/10.5220/0011976600003582

Kolibu, N. N., Saerang, I. S., & Maramis, J. B. (2020). Analisis Invesment Opportunity Set, Corporate Governance, Risiko Bisnis, Dan Profitabilitas Terhadap Nilai Perusahaan Consumer Goods Dengan High Leverage Di Bursa Efek Indonesia. Jurnal Ekonomi Dan Pengembangan, 8(1), 202–211.

Lambey, R. (2021). The effect of profitability, firm size, equity ownership and firm age on firm value. Archives of Business Research, 9(1), 128–139.

Martini. (2023). Determinan Kebijakan Dividen Dan Nilai Perusahaan. Sebatik, 27(2), 579–588. https://doi.org/10.46984/sebatik.v27i2.2351

Martini. (2024). Determinan Faktor Enterprise Value dari Sudut Pandang PBV dan Tobin ’ s Q Determinant Factors of Enterprise Value from PBV and Tobin ’ s Q Perspectives. Sebatik, 28(2), 410–417. https://doi.org/10.46984/sebatik.v28i2.2494

Martini, & Hariyani, R. (2023). Peningkatan Nilai Perusahaan Dari Sudut Pandang Current Ratio, Return on Asset, Debt To Equity Ratio Dan Kepemilikan Institusional. Sebatik, 27(2), 716–722. https://doi.org/10.46984/sebatik.v27i2.2338

Mbate, M. M., & Sutrisno. (2023). Effects of CEO Duality, Board Independence, Ownership Concentration, Company Age on Profit Persistence and Firm Value: An Empirical Study of Manufacturing Companies in West Java, Indonesia. The ES Accounting And Finance, 1(02), 54–60. https://doi.org/10.58812/esaf.v1i02.62

Ningrum, G. M., & Khomsiyah, K. (2023). Does The Investment Opportunity Set Strengthen The Effect of Profitability, Managerial Ownership and Capital Structure on Firm Value? Journal of Business Social and Technology, 4(1), 152–168. https://doi.org/10.59261/jbt.v4i1.130

Ningsih, F. A., Mulyani, S., & Salisa, N. R. (2023). Pengaruh Kepemilikan Manajerial, Kepemilikan Institusional, Pengungkapan Tanggung Jawab Sosial, Dan Kebijakan Pendanaan Terhadap Nilai Perusahaan (Studi Empiris Pada Perusahaan Sektor Consumer Non-Cyclicals Yang Terdaftar Di Bursa Efek Indonesia Periode 2. RELEVAN : Jurnal Riset Akuntansi, 4(1), 1–16.

Pradnya, P. K. M., & Panji, S. I. B. (2022). The Impact of Investment Opptunity Set, Profitability, Liquidity, and Institutional Ownership on Firm Value With Dividend Policy As Moderating. Eirasia : Economics & Business, 8(August), 24–38.

Rafsanjani, M., Isnurhadi, I., Widiyanti, M., & Thamrin, K. H. (2024). Effect of managerial ownership and institutional ownership on firm value with profitability as an intervening variable in mining companies listed on the Indonesia Stock Exchange. International Journal of Social Sciences and Humanities, 8(2), 52–62. https://doi.org/10.53730/ijssh.v8n2.14958

Santoso, B. A., & Junaeni, I. (2022). Pengaruh Profitabilitas, Leverage, Ukuran Perusahaan, Likuiditas, dan Pertumbuhan Perusahaan Terhadap Nilai Perusahaan. Owner : Riset & Jurnal Akuntansi, 6(2), 1597–1609. https://doi.org/10.33395/owner.v6i2.795

Sembiring, S., & Trisnawati, I. (2021). Faktor-Faktor yang mempengaruhi Nilai Perusahaan. JURNAL BISNIS DAN AKUNTANSI, 21(1a-2), 173–184.

Sugosha, M. J. (2020). The role of profitability in mediating company ownership structure and size of firm value in the pharmaceutical industry on the Indonesia stock exchange. International Research Journal of Management, IT and Social Sciences, 7(1), 104–115. https://doi.org/10.21744/irjmis.v7n1.827

Supriadi, I. (2020). Metode Riset Akuntansi (1st ed.). Deepublish.

Surya, T. L., Abdallah, Z., & Zano, J. A. (2024). Analysis of the Influence of Institutional Ownership and Managerial Ownership on Firm Value with the Proportion of Independent Board of Commissioners as a Moderating Variable. TOFEDU : The Future of Education Journal, 3(4), 1046–1055.

Tangngisalu, J., Halik, A., Marwan, & Jumady, E. (2023). Leverage Analysis, Investment Opportunity Set, and Ownership of Company Value. Journal of Law and Sustainable Development, 11(5), 1–21. https://doi.org/10.55908/sdgs.v11i5.992

Trafalgar, J., & Africa, L. A. (2019). The effect of capital structure, institutional ownership, managerial ownership, and profitability on company value in manufacturing companies. The Indonesian Accounting Review, 9(1), 27–38. https://doi.org/10.14414/tiar.v9i1.1619

Widyasari, T. E. (2019). Faktor-Faktor Yang Mempengaruhi Penghindaran Pajak Perusahaan Properti Dan Real Estate. Jurnal Paradigma Akuntansi, 1(3), 937. https://doi.org/10.24912/jpa.v1i3.5598

Wijaya, H., Tania, D. R., & Cahyadi, H. (2021). Faktor-Faktor Yang Mempengaruhi Nilai Perusahaan. Jurnal Bina Akuntansi, 8(2), 109–121.

Yuwono, W., & Aurelia, D. (2021). The Effect of Profitability, Leverage, Institutional Ownership, Managerial Ownership, and Dividend Policy on Firm Value. Journal of Global Business and Management Review, 3(1), 15. https://doi.org/10.37253/jgbmr.v3i1.4992

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.