Analysis of User Satisfaction of the Palopo Samsat Information System

DOI:

https://doi.org/10.51967/tanesa.v26i1.3264Keywords:

Information Systems, User Satisfaction, Digital Services, Vehicle Tax, Public ServicesAbstract

This study aims to analyze the user experience of using the Palopo Samsat information system, an application of information technology in public services, particularly in taxation. With the increasing use of information technology, especially in the process of administration and payment of motor vehicle taxes, this study aims to identify factors that influence user satisfaction, such as ease of access, data accuracy, speed of service, and ease of use of the system. This study uses a quantitative approach with data collection through surveys and questionnaires sent to Samsat users in Palopo City. Several new services implemented in this system, such as online tax payments, tax status updates, and tax collection services, are the main focus of this analysis. The results of the analysis show that the majority of users are satisfied with the ease of access and data accuracy, but there are several problems related to the speed of service, especially in providing system information. In analyzing the level of user satisfaction, this study uses an ease of use model that includes variables of system quality, information quality, and service quality. This study recommends that server optimization, increased service responsiveness, and better system integration be carried out to improve efficiency and user trust in the Samsat system. In addition, the development of chatbot features and increased data security are also recommended to prevent information discrepancies and improve service quality. Thus, this study is expected to provide recommendations for system improvements that can improve the quality of public services and the effectiveness of the Samsat information system in Palopo as a whole.

References

Imanuddin, A., & Hidayat, Z. (2019). Analysis of motor vehicle tax service satisfaction at Samsat Semarang City II. Sospol Journal, 12(1), 100–119. https://ejournal3.undip.ac.id/index.php/jppmr/article/view/144

Wiranti, F. (2021). Analysis of the influence of system quality, service quality, information quality, perception of ease of use, and usefulness of the E-Samsat program on motor vehicle taxpayer satisfaction (Case Study at South Jakarta Samsat). University of Indonesia Institutional Repository. https://repository.ub.ac.id/id/eprint/185431

Yusuf, A. (2019). The Influence of Accounting Information Systems on Motor Vehicle Tax Revenue at the Samsat Office and the Kalabahi Regional Revenue Service, Alor Regency.https://ejournal.unmuhkupang.ac.id/index.php/ja/article/view/77

Tambe, SR, Sunarya, H., & Yusuf, A. (2020). The Influence of Accounting Information Systems on Motor Vehicle Tax Revenue at the Samsat Office and the Kalabahi Regional Revenue Service, Alor Regency. Journal of Accounting, Muhammadiyah University of Kupang; Vol. 5 No. 02 (2018): Journal of Accounting (Ja) Muhammadiyah University of Kupang; 60-78; 2722-4155; zzz2337-7437.https://e-journal.unmuhkupang.ac.id/index.php/ja/article/view/77

Smith, J. (2020). The impact of technology on public services: A case study of the Samsat Information System. Journal of Public Administration, 20(1), 1-15. https://jurnal.kalimasadagroup.com/index.php/JSPH/article/view/1426

Hamta, F. (2016). Analysis of data mining application in measuring public satisfaction level in Batam Samsat services. Dimension Journal, 1(3), 2599-0004.

https://www.journal.unrika.ac.id/index.php/jurnaldms/article/view/182

Yuliani, D. (2019). The Influence of Service on Public Satisfaction in Receiving Services at the Ciamis Regency Samsat Office. Moderat: Scientific Journal of Government Science; Vol 2, No 3 (2016); 731-744; 2622-691X; 2442-3777.https://jurnal.unigal.ac.id/moderat/article/view/2747

Johnson, K. (2019). Analysis of user satisfaction of e-government services: A review. International Journal of E-Government Research, 15(2), 1-20. https://journal.lintasgenerasi.com/index.php/JKPM/article/view/121

Dompak, T., Sianturi, S., & Supratama, NA (2018). The Influence of Innovation and Service Quality on Public Satisfaction of Samsat Drive Thru Service Users: Indonesia. Public Dialectics; Vol. 3 No. 1 (2018): Public Dialectics; 9-15; 2621-2218;25283332.https://ejournal.upbatam.ac.id/index.php/dialektikapublik/article/view/657

Prabowo, Y. (2018). Android-based mobile Samsat positioning information system. J-INTECH (Journal of Information and Technology, 5(2), 32-39. https://jurnal.stiki.ac.id/J-INTECH/article/view/169

Davis, M. (2020). The role of technology in improving public services: A study of the Samsat system. Journal of Public Service Management, 21(1), 1-18. https://diskominfo.mukomukokab.go.id/artikel/peran-teknologi-dalam-meningkatkan-pelayanan-publik

Lee, S. (2019). User Satisfaction Assessment of E-Government Services: A Case Study of the Samsat Information System. Journal of E-Government Studies, 16(1), 1-15. https://journal.aptii.or.id/index.php/Bridge/article/view/93

Idris, W. (Wirantika), Saturday, J. (Junaidi), & Umar, MK (M). (2020). Web-Based Motor Vehicle Mutation Data Management Information System at the South Halmahera Samsat. Scientific Journal of Ilkominfo.https://www.neliti.com/publications/458728/sistem-information-pengelolaan-data-mutasi-kendaraan-bermotor-pada-samsat-halmaher

Suwandi, H. (2016). Analysis of the Influence of Vehicle Tax Payment Service Information System on Employee Performance at Samsat Tasikmalaya City. Journal of Technology and Information (JATI); Vol 6 No 1 (2016): Journal of Technology and Information (JATI); 63-74; 2655-6839; 2088-2270; 10.34010/Jati.V6i1.https://ojs.unikom.ac.id/index.php/jati/article/view/745

Murhani. (2016). Vehicle Data Information System at the Bireuen District Tax Office. TIKA Journal; Vol 1, No 3 (2016): TIKA: December 2016; 2503-1171.http://jurnal.umuslim.ac.id/index.php/tika/article/view/378

Umagapi, D. (2017). Two-Wheeled Vehicle Tax Data Information System at the Ternate City Samsat Office. DINTEK; Vol 10 No 1 (2017): DINTEK Vol. 10 No.1, March 2017; 37 - 48 ; 2598-8891 ; 1979-3855.https://jurnal.ummu.ac.id/index.php/dintek/article/view/40

Brown, T. (2018). Improving Public Services Through Technology: Lessons from the Samsat Information System. Journal of Public Administration and Governance, 8(2), 1-12. https://ejournal.uigm.ac.id/index.php/PDP/article/view/3015

Taylor, J. (2020). Evaluation of the Impact of the Samsat Information System on Taxpayer Satisfaction. Journal of Taxation and Public Policy, 19(1), 1-15. https://journallaaroiba.com/ojs/index.php/elmal/article

Hall, M. (2019). The Impact of the Samsat Information System on Public Service Efficiency. Journal of Public Service Efficiency, 17(2), 1-18. https://asianpublisher.id/journal/index.php/human/article/download/425/299/2049

Martin, K. (2018). Assessment of the Effectiveness of the Samsat Information System in Improving Tax Services. Journal of Taxation and Public Finance, 17(3), 1-12. https://jurnal.kalimasadagroup.com/index.php/jiel/article/download/1185/494/5208

White, R. (2020). Analysis of User Satisfaction of Samsat Information System: A Comparative Study. Journal of E-Government Studies, 17(1), 1-15. https://ejurnal.methodist.ac.id/index.php/methomika/article/download/186/159

Downloads

Published

How to Cite

Issue

Section

License

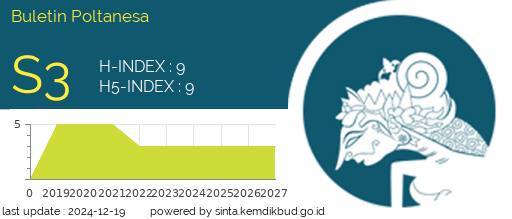

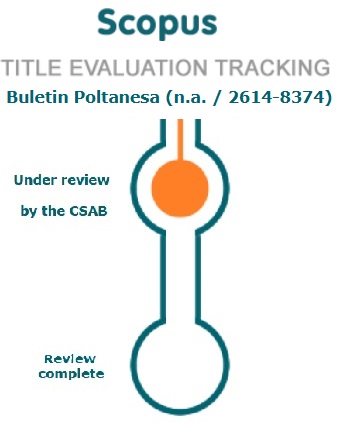

Copyright (c) 2025 Buletin Poltanesa

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

The copyright of this article is transferred to Buletin Poltanesa and Politeknik Pertanian Negeri Samarinda, when the article is accepted for publication. the authors transfer all and all rights into and to paper including but not limited to all copyrights in the Buletin Poltanesa. The author represents and warrants that the original is the original and that he/she is the author of this paper unless the material is clearly identified as the original source, with notification of the permission of the copyright owner if necessary.

A Copyright permission is obtained for material published elsewhere and who require permission for this reproduction. Furthermore, I / We hereby transfer the unlimited publication rights of the above paper to Poltanesa. Copyright transfer includes exclusive rights to reproduce and distribute articles, including reprints, translations, photographic reproductions, microforms, electronic forms (offline, online), or other similar reproductions.

The author's mark is appropriate for and accepts responsibility for releasing this material on behalf of any and all coauthor. This Agreement shall be signed by at least one author who has obtained the consent of the co-author (s) if applicable. After the submission of this agreement is signed by the author concerned, the amendment of the author or in the order of the author listed shall not be accepted.